Preparing a balance sheet is an essential practice that should be conducted either on a monthly or quarterly basis. This financial statement shows your company’s financial position by detailing the assets, liabilities, and shareholders’ equity of your company. Let’s discuss this in-depth about this subject.

How to prepare a balance sheet?

A balance sheet shows a clear picture of your company’s financial update. It helps with financial planning and provides businesses visibility into the assets, liabilities, and owner’s equity. It’s one of the three major financial statements that a business person is required to represent financial modelling & accounting – the two other statements are income and cash flow statements.

At its essence, a balance sheet is one of the accurate ways to evaluate the company’s financial health. When fleshed out, the balance sheet displays:

What the business owns

What the business owes

Investment in the company

This means your company’s assets must always be matched with the sum of liabilities and equity. Some businesses consider hedge accounting to decrease the impact of instability in financial statements, still, the sheet must be balanced. If one of any is out of alignment, your calculations are incorrect.

Distinguish between a balance sheet and an income statement

A Profit & Loss (P&L) statement, also referred to as an Income Statement, lists out an organization’s revenue streams – Sales, etc. and Expenses – Payroll and Operating Expenses, etc. for a particular period.

while a Balance Sheet includes a company’s assets – Cash, Securities, Inventory, etc. and liabilities – debt payments, taxes, rent, etc. at a certain point in time.

An Income Statement shows a company’s profitability, revenue, and margins over a period. On the other hand, the monthly financial reporting of the balance sheet lets you know its financial status and solvency over some time.

What is The purpose of a Balance Sheet?

A balance sheet that represents a company’s overall financial health at a particular period. It’s a complicated measurement internally as well as externally, but for different motives:

Internal Examination

A Balance Sheet helps you with a business’s situation. By evaluating your liquidity conditions, such as cash & receivable, you may get an idea of whether you can handle a market shock of upcoming expenses. Further, you can examine historical trends in your company’s assets & liability to make sure your business is going in the right direction or identify problem areas. If numbers don’t look good, it may indicate an internal shift in the way your business operates.

External Examination

Balance Sheet is a solution that allows investors, stakeholders, regulators, and lenders to identify the financial state of a business, currently available resources, and the way they were financed. For investors, this can aid them to see if investing in the company is a smart decision or not. They might extrapolate on these numbers to ensure other financial position metrics, such as equity multiplier, debt-to-debt ratio, liquidity, and profitability. A balance may help External Auditors reaffirm that the company is following the reporting laws.

What’s on a balance sheet?

Practically every balance sheet entails the following equation:

Assets = Liabilities + Shareholder’s equity

however, this equation is based on a particular date which is the reporting date. Though it relies on your business, mostly, a balance sheet is mostly prepared and distributed every quarter or monthly. Large-scale businesses prefer to maintain while small sizes of businesses typically prepare quarterly statements.

A Balance Sheet consists of three key elements that are:

1. Assets

The assets in the balance sheet represent what value items your business owns. These assets are generally arranged in order of liquidity – in easy words, how seamlessly they can converted into cash. This typically is divided into two categories:

- Current assets – Assets that may be converted into cash within a year. This is divided into some subcategories:

- Cash & cash equivalents – Your most liquid assets that are kept in your bank account, like cash, checks, and money.

- Accounts receivable – An amount that your clients owe and will pay shortly.

- Marketable securities – business investments that you can easily sell-off.

- Prepaid expenses – Valuables you already have paid for – insurance or rent.

- Inventory – Raw materials, Finished Products, equipment.

- Long-term assets – Long-term assets, also known as non-liquid assets and non-current assets, such as the value of the company’s property, plant, and equipment that are used for more than one year, excluding depreciation:

- Fixed assets – Equipment, property, buildings, and machinery.

- Intangible assets – Nonphysical assets – patents, licenses, copyrights, and franchise agreements.

- Long-term securities – Investments that cannot be sold off in a year, like bonds or real estate.

2. Liabilities

Liability in the Balance Sheet displays what amount you currently owe to others, this entails recurring expenses and other debts. Liabilities include two subcategories:

- Current liabilities – Utilities, accounts payable, rent, taxes, accounts payable, and payments on long-term debt interest such as credit cards or business loans.

- Long-term liabilities – Long-term debts & Bonds payable.

3. Shareholder’s equity

The shareholder in the Balance Sheet showcases the fund values that shareholders have invested in the company and retained earnings. For retained earnings, the company should pay out dividends from the net worth.

Shareholders’ Equity = Total Assets – Total Liabilities.

How to make a balance sheet in 8 steps

Now that you know what’s in a balance sheet, how do you make your own? Follow these steps:

Step 1: Finalize the Balance Sheet date

A balance sheet shows all the assets of your business, liabilities, and equity of shareholders on a particular date of the year, or within a given time. Typically companies create reports quarterly, merely on the last date of March, June, September, and December. Companies can also choose monthly Balance Sheet Preparation, in which they have to report on the last date of every month.

Step 2: List all of your assets

Next is to list out all the current assets in separate line items. To make this section more actionable, it’s an appropriate way the separate them in liquidity order. Highly liquid items like accounts receivable and cash go first, while non-liquid assets, such as inventory are placed at the last. Now choose non-current or long-term assets and non-monetary ones also.

Step 3: Sum Up All The Assets

Once you have detailed all the asset categories, add up them all. The final tally will be considered as the total assets category. Now, double-check the figure against the general ledger of the company to ensure that the equation is correct.

Step 4: Ensure current liabilities

Now, enlist the current liabilities that are due within one year of the balance sheet date, including accounts payable, accrued liabilities, and short-term notes payable.

Step 5: Calculate long-term liabilities

List the liabilities that will not be recovered within the year, such as long-term notes, pension plans, bonds payable, and mortgages.

Step 6: Add up liabilities

Make a sum of all the current liabilities and long-term liabilities to figure out the total liabilities.

Step 7: Calculate the owner’s equity

Ensure the retained earnings and working capital, and the total shareholders’ equity of your business. Retained earnings are the revenue that is reserved for reinvestment (not shared with shareholders as dividends). Shareholders’ equity is the sum of share capital and retained earnings.

Step 8: Combine Liabilities & Owner’s Equity

If your assets are equal to the sum of Liabilities and Equity, you’ve performed the correct balance sheet. If not, it’s incorrect and you will have to review your work.

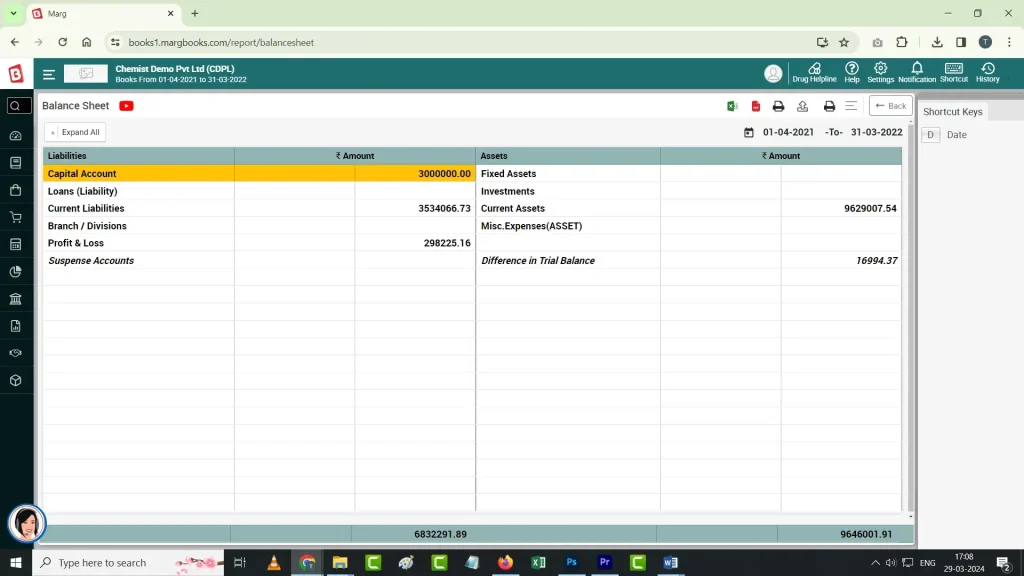

However, instead of creating a Balance Sheet manually, you can integrate Online Accounting software, like MargBooks that auto-manages a business’ accounting, minimizing potential errors and maximising efficiency & accuracy. Additionally, it maintains all the aspects of businesses and eases their daily operations.

Also Read:

Understanding the Basics of Balance Sheet Structure

A Guide to Balance Sheet Formats

How to Manage Finances: A Guide to Balance Sheet Tools

Frequently Asked Questions

What is a balance sheet?

The balance sheet is the financial condition of a company which is prepared on every reporting date, monthly, quarterly, or yearly. This process includes total assets, liabilities, and shareholders’ equity. All the assets are enlisted on one side and liabilities & equity an the other hand. Both sides must be matched.

How to prepare a monthly balance sheet?

The balance sheet is mostly prepared every quarterly or yearly. But in some large sizes of organizations, it’s prepared every month. For the monthly balance sheet, sum up assets and liabilities & equity of shareholders accordingly, if the equation matches the balance sheet is correct and if not, review it.

What is the format of a balance sheet?

A balance sheet is followed by particular formats, either Horizontal or Vertical form. In Horizontal form, assets and liabilities are displayed side by side and in Vertical form, assets & liabilities are shown vertically.

What is the purpose of the balance sheet?

The balance sheet shows a company’s financial position at a specific moment by showing the assets, liabilities, and equity, meaning what a company owes and owns. Additionally, the Balance Sheet Analysis shows the company’s ability to pay obligations that convince investors to invest in your company.

NIce blog