The definition of a balance sheet is a financial statement that shows the company’s assets, liabilities, and shareholder equity at a particular time point. Balance sheets offer the basics to compute return rates for investors and analyse a company’s capital structure.

In short, the definition of balance sheet is an organisation’s financial statement that demonstrates what a business owns and owes, as well as the amount of money invested by stakeholders. Balance sheets may be deployed with other essential monetary statements to conduct analysis or figure out financial ratios.

What is the Definition of Balance Sheet?

A balance sheet is a financial statement. Additionally, a balance sheet analysis is pivotal to examining a company’s worth, also called ‘book value.’ The balance sheet is prepared by listing and tallying up all of an organisation’s assets, liabilities, and owner’s equity as of a specific date or reporting date.

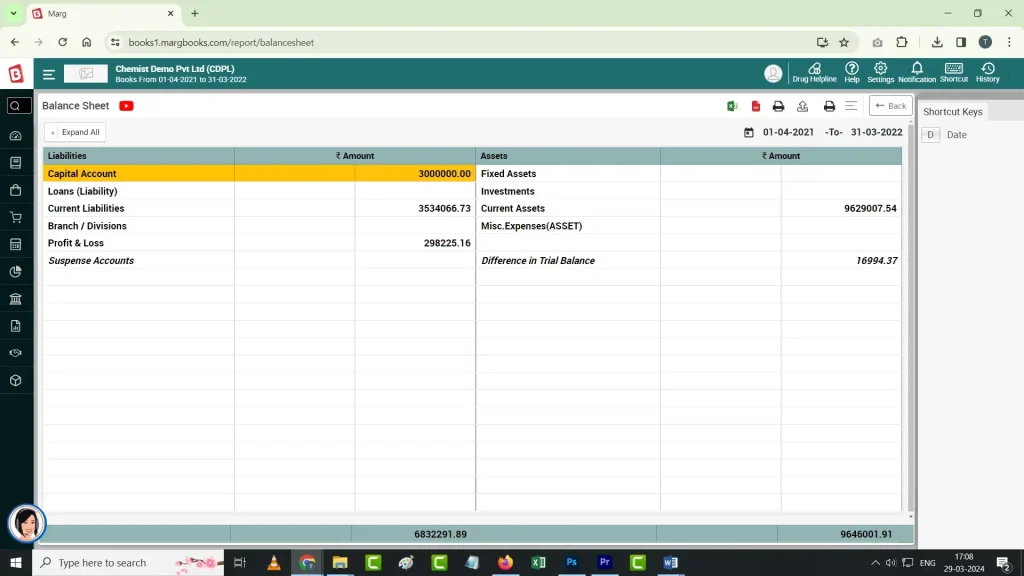

Typically, a balance sheet can be prepared and distributed on a monthly or quarterly basis, depending on recurrence as ensured by policy and terms of the company. The key technique to maintain a balance sheet is to install a web balance sheet system like MargBooks accounting software that maintains a business’ financial reports, automates payments, and eases controlling the entire process.

What is the Purpose of the Balance Sheet?

Typically, the definition of balance sheet is the financial position of an organisation which helps them in many ways. This article post will take to the foremost purposes of the balance sheet. Let’s start discussing some of them:

- Assess Ability to Pay Obligations

There are multiple subsets of information that may be utilised to earn an understanding of the short-term financial upgradation of a company. With the help of balance sheet analysis, one can evaluate whether a business has access to sufficient funds in the short term to pay off its obligations for the short term.

- Analyze Borrowing Level

A business person also can compare the total debt to the total equity listed on the balance sheet, to know if the resulting debt-to-listed ratio amplifies a hazardously highest level of borrowing. This information is crucial for lenders and creditors, who need to identify if the extension of additional credit might lead to a bad debt.

- Evaluate the Ability to Pay Dividends

Investors require and also like to inspect the cash amount on the balance sheet to identify if there is sufficient available to pay them a dividend. However, this judgement may require to be altered depending on the urge to invest additional funds in the company.

- Evaluate the Value of the Asset

A potential obtainer of a firm checks a balance sheet to notice if any asset can potentially be stripped away without exploiting the underlying business. For instance, the receiver may compare the balance of reported inventory to sales to get an inventory turnover level, which may signal the existence of inventory in excess. The same example goes with the accounts receivable. Or, the fixed assets’ total tends to compare to sales to derive a turnover measure of fixed assets, which is then compared to top-class businesses in the same realm to figure out if the fixed asset investment is very high.

- Preparation and Planning

For tax preparation and planning, keeping accurate records of the company is essential and to complete appropriate tax returns, businesses should retain financial reports that are updated and organised.

This allows your accountant to create your business returns and also determines you don’t pay the extra taxes. Additionally, you will be obliged to provide a full set of financial records along with financial statements and receipts for examination in the case of audit.

- Business Planning

By examining your organisation’s finances, you can see potential problems that become enlarged. Most small-scale businesses fail because of cash flow issues that may be detected and resolved with precise and current balance sheets.

Business persons frequently underestimate the value of budgeting, excess pay on beginning expenditures, and stop attempting to finance for a longer time. Such a typical financial problem may be tackled by generating a solid business strategy and using financial statements to notify business choices.

Also read: How to Manage Finances: A Guide to Balance Sheet Tools

What are the major components of a Balance Sheet?

A Balance Sheet Structure includes assets, liability, and owner’s equity. Let’s have a deep dive into these components:

1.Assets

An asset is anything that is owned by a firm and holds inherent, quantitative value. A business could, if required, turn an assent into cash via a procedure ‘liquidation.’ Assets typically are indicated with a positive sign (+) over a balance sheet and classified into two categories, which are current assets and noncurrent assets.

- Current assets include a company expect anything to convert into cash within a year, such as:

- Cash & cash equivalents

- Prepaid expenses

- Inventory

- Marketable securities

- Accounts receivable

- Noncurrent assets entail long-term investments that aren’t expected to turn out as cash in the short term, such as:

- Land

- Patents

- Trademarks

- Brands

- Goodwill

- Intellectual property

- Equipment deployed to produce goods or perform services

As businesses invest in assets to accomplish their purpose, they must generate a user-friendly understanding of what they are. In its absence, it may be complicated to comprehend the balance sheet and other financial documents that show a company’s position.

2. Liabilities

Liability possesses the opposite meaning of the asset. An asset is something that a company owns, while a liability is what a company owes. Liabilities are legal and financial obligations to pay to a debtor, which is why they’re tallied as negative (-) on a balance sheet.

Unlike assets, liability is categorised into two parts which are current liabilities and non-current liabilities.

- Current liabilities are any liability because of the debtor within one year, which may include:

- Payroll expenses

- Rent payments

- Utility payments

- Debt financing

- Accounts payable

- Other accrued expenses

- Noncurrent liabilities typically are long-term obligations or debts that will not be repaid within one year, which might include:

- Leases

- Loans

- Bonds payable

- Provisions for pensions

- Deferred tax liabilities

Liabilities may also entail an obligation to provide goods or services in the future.

3. Owners’ Equity

Owners’ equity or shareholders’ equity, is typically defined as anything that relates to the business’ owner after accounting of any liabilities.

When summing up a business’s assets and deducting its liabilities, what remains is the owners’ equity. This component usually comprises two main parts. Firstly, it includes funds contributed to the business through investments in exchange for ownership, often represented by shares. Secondly, it encompasses the earnings accumulated by the company over time. As a business owner, you may seek an online balance sheet software company like MargBooks to streamline the process and scale up accuracy.

Assess Your Company’s Financial Health With Balance Sheet!

For every business owner, it’s essential to maintain a balance sheet so that they can evaluate what level their business’ finances stand. Maintaining a balance sheet also can help you make your taxation easy, limit the possible issues, analyses risk and return etc,.

To streamline and accurate balance sheets, businesses must consider balance sheet software that will enhance accuracy, and provide real-time reports, data safety, cost savings, and more. If you require online balance sheet software to install, the best option is MargBooks’ software which is also an affordable approach for small businesses.

Also Read:

How to prepare a balance sheet by month summary?

A Guide to Balance Sheet Formats

How to Manage Finances: A Guide to Balance Sheet Tools

Frequently Asked Questions

How to Calculate a Working Capital Balance Sheet?

Working capital is when current liabilities are deducted from current assets, the left balance would be working capital. You may find these figures on your balance sheet. Working capital is a metric that small-scale businesses should be tracking every week. Hence, profits are nice, but working capital is a must that pays the bills.

(Working capital – Current assets – current liabilities)

What Is a Year-End Balance Sheet for a Small Business?

In a small business, financial statements are prepared regularly to alert them about their financial conditions. These statements provide creditors, investors, and management with information about the earning revenues. One of these statements is a balance sheet that is prepared either at the end of the year or fiscal year, depending on the company’s policy.

What Are the Specified Balance Sheet Items to Ensure the Creditworthiness of an organisation?

When seeking financial assistance for your organization, whether it’s for a credit loan line or other financial services, the major factor that banks look for is your business’s creditworthiness. Specific balance sheet items that are used to ensure the creditworthiness of a company are Debt-to-Equity Ratio, Debt Service Coverage Ratio, Current Ratio, Quick Ratio Interest Coverage Ratio, Profitability Ratios, Cash Flow Metrics, and growth trends

Why are companies interested in avoiding debt on their balance sheets?

Though having debts on the balance sheet is good in certain examples, having a higher level may make a company insolvent or unattractive to investors and lenders. It makes managing payables complicated for success. Firms have to track their utilisation of short-term credit lines, bonds and mortgages among other instruments of debt to make their balance sheet appearance sharp.

What are the major components of a balance sheet?

A Balance Sheet Structure requires assets, liabilities, and shareholders equity. Assets entail cash, property, machinery, stock, and accounts receivable. Whereas liabilities include loans, account payables, taxes and payroll. Shareholder’s equity is anything that belongs to the business owners after accounting for any liabilities.

What Are Specific Examples of Assets & Liabilities?

A balance sheet shows two sides, one is assets and another is liabilities. Usually, general individuals consider assets as cash but it’s what a company owns. While liabilities demonstrate expenditures and what an organisation owes.

Examples of Assets – Cash, accounts receivable, inventory, current property, machinery and equipment.

Examples of Liabilities – Small business loans, account deliverables, payroll, and taxes

How to prepare a balance sheet?

A step-by-step guide is prepared to simplify your query for ‘how to prepare a balance sheet.’ Find them below-

1. Create a heading “Balance Sheet”

2. Use the basic accounting equation to separate each section

The assets section in the left corner on the top

Liabilities section in the right corner at the top

The equity section of owners below liabilities

The total assets category of the balance sheet at the bottom

Add all the liabilities and owner’s equity category under total assets

3. Include all of your assets

Total Assets = Current Assets + Noncurrent Assets + Intellectual Property

4. Create a section for liabilities

Total Liabilities = Current Liabilities + Non Current Liabilities

5. Create a section for owner’s equity

Stakeholders’ Equity = Total Assets − Total Liabilities

6. Add total liabilities to the total owner’s equity