Are you a business owner and want to know ‘what is the balance sheet formats?’ if yes, then you have jumped on the right page. Continue reading about the balance sheet in detailed form-

A balance sheet is a report of a company’s current financial position at the end of the accounting period, usually a particular date month or year. A balance sheet items include all the assets, liabilities, and equity.

The major purpose of a balance sheet account is to deliver to stakeholders, like creditors, investors, and management information about the company’s financial standing

What is the balance sheet?

A balance sheet is a pivotal financial report of a business that signals its financial condition over time. The balance sheet analysis provides an organization’s performance and financial stability.

The business’s creditors and investors can be ensured how the business can efficiently utilize its assets and resources. It is an accounting equation in the form of reports, that is

Total assets = total equity + total liabilities

What are the Key Features of Balance Sheets?

A few key features of a Balance Sheet are:

- A balance sheet is a combination of liabilities and assets. It showcases the value and nature of your organization, allowing you to identify the position of the capital on a specific date.

- However, it does not reflect any revenues or expenses.

- Balance sheets are based on the equation “Asset = Liability + Capital”, and both must always be equal.

- It considers the credit and debit balances of a company’s current and personal accounts. Plus, the credit balance falls under the personal account and is referred to as the liability of a business. In comparison, the debit balance is a part of a real account and is called the assets of a business.

- A company’s accountants usually produce the balance sheet account on the accounting year’s last day. This is because it represents the final stage of preparing financial statements and requires an evaluation of the company’s trading activities and profit and loss accounts.

How to make a balance sheet?

An effective format should be followed to prepare a balance sheet. Below a comprehensive guide is given that will let you know how to make a balance sheet:

- Create a Trial Balance

Create a report regularly within your accounting program. If operating manually, consider ending the balance of every general ledger account to transfer to a spreadsheet.

- Organize the Trial Balance

Arrange the initial trial balance to conform with the appropriate accounting framework. Ensure all adjusting entries are completely recorded so the auditor can understand during balance adjustment.

- Implement Expense & Revenue Accounts

Clear all accounts from the trial balance other than assets, equity, and liabilities. The excluded accounts are used to make an income statement.

- Sum Up Remaining Accounts

Overall trial balance accounts required for the balance sheet account, including

- Cash

- Accounts receivable

- Fixed assets

- Other assets

- debt

- Accounts payable

- Accrued liabilities

- Other liabilities

- Inventory

- Common stock

- Retained earnings

- Validate the Balance Sheet

Determine whether the sum of the overall asset balance matches the addition of liabilities and shareholders’ equity accounts.

- Display in the Needed Format

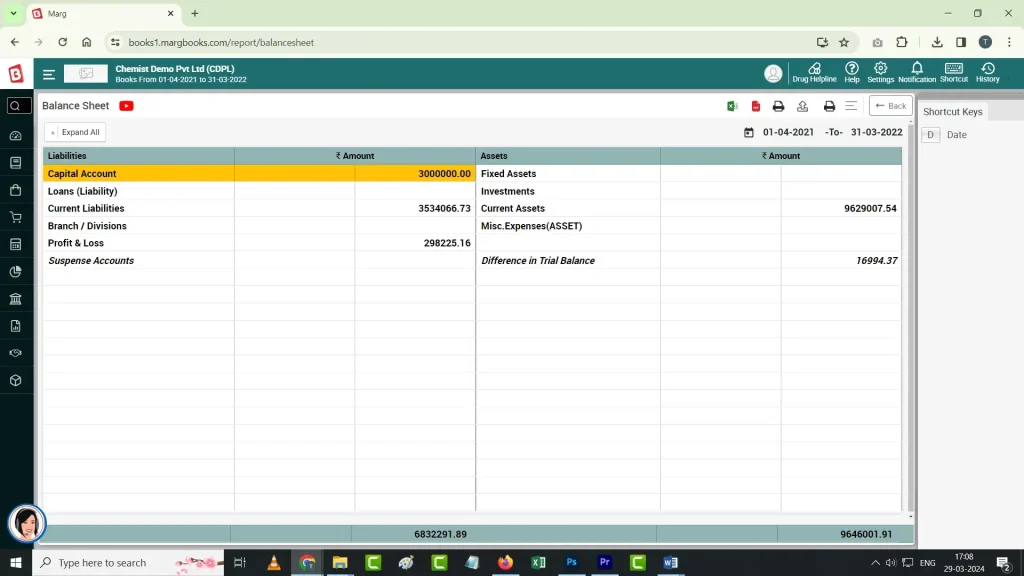

Ensure the appropriate format to display the finalized Statement of Financial Position, as the one presented for an example below.

– Balance Sheet Example

Here is the Balance Sheet example below as of December 31, 2022 and 2023.

| particular | Amount (2022) | Amount (2023) |

| Equity & liabilities | ||

| Shareholder funds | 50,000 | |

| Common stock retained earnings | 60,000 | 1,10,000 |

| Liabilities | ||

| Account payable | 25,000 | |

| Short-term loans | 10,000 | |

| Accrued liabilities | 8,000 | 43,000 |

| Long-Term Liabilities | ||

| Long-term loans | 60,000 | |

| Deferred tax liabilities | 12,000 | 72,000 |

| Total | 2,25,000 | |

| Assets | ||

| Current Assets | ||

| Account receivable | 60,000 | |

| Inventory | 40,000 | |

| Prepaid expenses | 30,000 | 1,30,000 |

| Fixed Assets | ||

| Property and Plant | 1,00,000 | |

| Accumulated depreciation | -5000 | |

| Net Fixed Assets | 95,000 | |

| Total | 2,25,000 |

A manual method may create some confusion, hence you must use an online balance sheet account software to avoid inaccuracy, and inappropriate data, provide data security, manage accounts, automate payment reminders, and more. So, seek a profound company nearby you and start implementing a cloud balance sheet solution.

What are the Types of Balance Sheet formats?

Various types of balance sheet serve different motives in displaying financial information. Continue reading to find some of them in those formats and to know how to make a balance sheet with those formats:

- Classified Balance Sheets

A Classified balance sheet items that are equity, liabilities, and assets are categorized into specified groups, offering a highly organized and detailed look at the organization’s financial position.

- Non-classified Balance Sheet

Unlike a classified financial statement a non-classified balance sheet account doesn’t divide assets, liabilities, and equity into particular categories. It makes these components look more general and less detailed manner.

- Comparative Balance Sheet

A comparative balance sheet considers including financial data from more periods, ensuring a comparison of changes in equity, liabilities, and assets over time. This assists in evaluating the organization’s financial performance and recognising trends.

- Vertical Balance Sheet

The vertical format balance sheet displays financial data in a columnar layout, featuring distinct columns for assets, liabilities, and equity. Also referred to as the updated balance sheet account format, it offers a well-organized depiction of the makeup and relative proportions of each element.

- Horizontal Balance Sheet

The next one of the formate’s types of balance sheet is a horizontal balance sheet that displays the financial information in a format of rows, listing assets, liabilities, as well as equity from left to right sequentially. This type of balance sheet emphasizes the chronological sequence and facilitates remoting changes over time.

- Consolidated Balance Sheet

A consolidated type of balance sheet is a financial statement that brings together the parent company’s financial information and its subsidiaries. Furthermore, it offers an integrated look at the financial condition of the whole consolidated entity.

- Provisional Balance Sheet Format

Another one of the profound types of balance sheet format is the provisional balance sheet which has the same details as any other balance sheet – equity, liabilities, and assets. The only difference is the information is temporary.

They’re also called as unaudited balance sheets. Companies implement provisional balance sheets to generate for financial audits. Additionally, they determined that there are no financial problems that require attention when organizations need to report updated data.

A provisional balance sheet may be finalized at any point during the year, although it is typically prepared at the close of the fiscal year. It incorporates assets, liabilities, and equity, with dates potentially subject to adjustments.

You simply may utilize an online balance sheet system to ease the whole preparation procedure of the balance sheet account. The software will also ensure the accurate financial report of your business, provide first-class safety, automate invoicing and more, and the best part is that the software comes at an affordable price. So whether a large scale or small scale business, the tool can be affordable to every business.

Maintain Accurate Balance-Sheet For Your Business Prosperity!

You may pick any recent and updated format to maintain your company’s balance sheet to identify where your company’s financial condition stands. The sheet will present your financial report to investors and creditors for loan to help them understand your company’s situation.

However, the manual way is always prone to errors no matter how careful you are. Cloud balance sheet software eliminates the risk of errors, provides a real-time report that you can access anytime and anywhere from any device, protect your data from theft, etc.

MargBooks offers online balance sheet software which is the no.1 choice of businesses in India. The speciality of their software is to generate statutory reports like GST returns, protect against fishing attacks, and customizable invoices for a personalized touch, and an affordable approach for small businesses.

Also Read:

Understanding the Basics of Balance Sheet Structure

How to prepare a balance sheet by month summary?

How to Manage Finances: A Guide to Balance Sheet Tools

Frequently Asked Questions

What are the 5 types of financial statements?

5 Types of Financial Statements are-

Income statement

Cash flow statement

Statement of changes in equity

Balance sheet

Note to financial statements

What are the new format and old format of the balance sheet?

The old format of the balance sheet is a T-shaped balance sheet with two sides. All liabilities, including the owner’s capital, are shown on the left side, whereas assets are depicted on the other side. The T-shaped balance sheet continues to hold significance for sole proprietorships, partnerships, and other non-corporate entities.

The new balance sheet account format lists liabilities and equities at the top and assets at the bottom and is termed the vertical format balance sheet.

What is the format of a manufacturing account?

A manufacturing account is a part of a manufacturing company’s financial statements that display the cost of goods produced during a specific period. Typically the format of a manufacturing account incorporates opening stock, direct materials, direct labor, cost of goods manufactured, closing stock, factory overheads, and total manufacturing cost.