An accounting balance sheet elaborates on your organization’s financial situation. Also, the balance sheets helps in financial strategic planning as well as provides visibility into the company’s assets, liabilities, and owner’s equity. These three imperative financial statements require every business owner to perform modelling and accounting, the two other documents being an income and cash flow statement respectively.

What is a balance sheet?

A balance sheet is referred to as a financial statement of a business that demonstrates the company’s assets, liabilities, and equity of shareholders, or investments that shareholders have made. List cash flow, receivables, inventory, equipment, and investment on the Asset’s side. While considering account payables, long-term obligations, borrowings, and expenses on the liability side. The process helps you evaluate your business’s financial status.

Why is the balance sheet essential?

Maintaining a balance sheet on an annual basis is a foremost task for every business to assess its financial health. Additionally, the sheet reflects crucial financial data that are deployed in business transactions. The in-depth significance of the balance sheets is discussed below. Continue to explore:

Evaluate Risk and Return

A balance sheet consists of business assets and liabilities. Additionally, current and prolonged assets showcase your efficiency in generating cash and sustaining operations. Short and long-term debts reflect the financial obligations.

Ideally, if the assets exceed the liabilities, it indicates positive net worth. If you have more current liabilities than cash or asset balance, your organisation will probably need additional working capital from investors or lenders. A balance sheet also can show when levels of debts are unsustainable.

Secure Loans and Investors

Your balance sheet enables individuals to quickly comprehend the financial condition of your company. Most lenders demand the balance sheet to ensure a business’s financial status and creditworthiness.

Small-scale business persons usually underestimate the significance of budget, excessive spending on startup costs and wait for a longer period to seek credit. Further, these mutual financial complications may be neglected by developing a sound business plan and utilising finance statements to navigate business decisions.

Limit Potential Issues

The top-notch reason for an organisation is to create a profit. A well-performing business must show growing equity. If your company is not doing so, viewing particular assets and liabilities on your financial statement can assist you in figuring out the reason.

For instance, if the most shares of your assets are in inventory, that tends to create unnecessary risk. Inventory that doesn’t sell out or customers are showing interest in can become a severe liability.

To Make Tax Preparation Easier

Keeping precise and updated business records is pivotal for both tax planning and preparation. The IRS suggests that small business owners maintain organised and updated financial reports to create actual tax returns.

With your financial statements in sequence, your accountant or tax composer will be capable of precisely preparing your returns, and determining that you’re not paying taxes in excess than you should. Plus, during the IRS audit, you will be necessitated to present an entire set of financial reports for examination, including receipts and financial statements.

What are the Tips for preparing a balance sheet?

Preparing a balance sheet requires full focus and focus on collecting all the details. Plus, the sheet must contain accurate data for the actual financial report. You may look for some foremost tips that will allow you to create an appropriate balance sheet. Do continue reading to explore the below-explained tips:

- Ensure the reporting date (e.g., December 31st) and build the balance sheet in regular breaks (e.g., annually), which will let you compare your company’s present financial condition to previous periods and track changes.

- List assets of your organisation and liabilities, and ensure which are non-current and which are current, this will aid you in clearly understanding what the assets and liabilities are and how to classify them.

- Figure out the shareholders’ equity and examine the balance of your balance sheet, helping you track any errors.

- Consider a balance sheet template or example if you’re not aware of the format.

What is Balance Sheet Software?

Significant financial management is essential for the continuous growth and success of any business. It’s a combination of handsome strategy and the appropriate balance sheet tools to track earnings, expenses, and complete financial status. Plus, the balance sheet accounting tools streamline accurate records and minimise potential errors with manual techniques.

How does online balance sheet software benefit businesses?

In this article post, you will explore the reasons why an online balance sheet analysis tool is significant for business, as well as the benefits that owners can reap and streamline the balance sheet.

Real-Time Reports

A balance sheet analysis tool provides business owners with current financial reports. Further, businesses can create updated balance sheets promptly by centralising financial records and automating calculations, allowing stakeholders to generate timely and informed decisions.

Improved Accuracy and Compliance

Manual processes for spreadsheet-based accounting tend to cause errors and inconsistencies. Online balance sheet systems automate calculations and determine data preciseness, minimising the risk of errors and maximising compliance with regulatory requirements.

Streamlined Financial Reporting

Preparing and distributing financial reports might be time-consuming and labour-intensive. However, online balance sheet tools streamline the process by creating standardised reports in just a few clicks, saving time and requiring less effort for finance teams.

Improve Decision-Making

Access to comprehensive and precise financial data strengthens businesses to make data-driven decisions. In this manner, online balance sheet tools provide details into mere financial metrics, trends, and performance predictors, determining informed decisions and strategic planning.

Efficient Collaboration & Communication

Collaborating among shareholders is crucial for efficient financial management. Additionally, the web balance sheet tool facilitates seamless collaboration by enabling multiple users to access and make financial data up-to-date simultaneously which also improves communication and alignment across teams.

Scalability & Flexibility

As businesses grow, their financial handling requires changes. A true cloud balance sheet system ensures scalability and flexibility to adapt to changing business demands, accommodating evolution and expansion without the necessity for expensive balance sheet accounting tool replacements.

Cost Savings

Implementing balance sheet accounting tools removes the requirement for costly hardware, licences, and IT infrastructure. A balance sheet analysis tool provides subscription-based pricing models that allow all sizes of businesses to pay only for the features and resources they want, leading to cost savings and improved ROI.

Data Safety & Compliance

Cloud-based balance sheet tools maximise security by implementing robust security measures to safeguard sensitive financial data. With features like access controls, continuous security updates, and data encryption, small as well as large-scale businesses can be sure about compliance with data privacy and protect against cyber threats.

Prepare Precise Financial Statement With Online Balance Sheet Tools!

Creating annual financial reports and keeping the reports updated is essential for any business to evaluate its financial position. Further, the process is required for investors’ satisfaction with acquiring loans, to prevent potential issues, to streamline tax preparation, etc, Somehow, manual techniques are associated with several issues like errors, inaccurate records, and more which can be sidelined by employing online balance sheet accounting tools which ease the whole process and ensure accurate data.

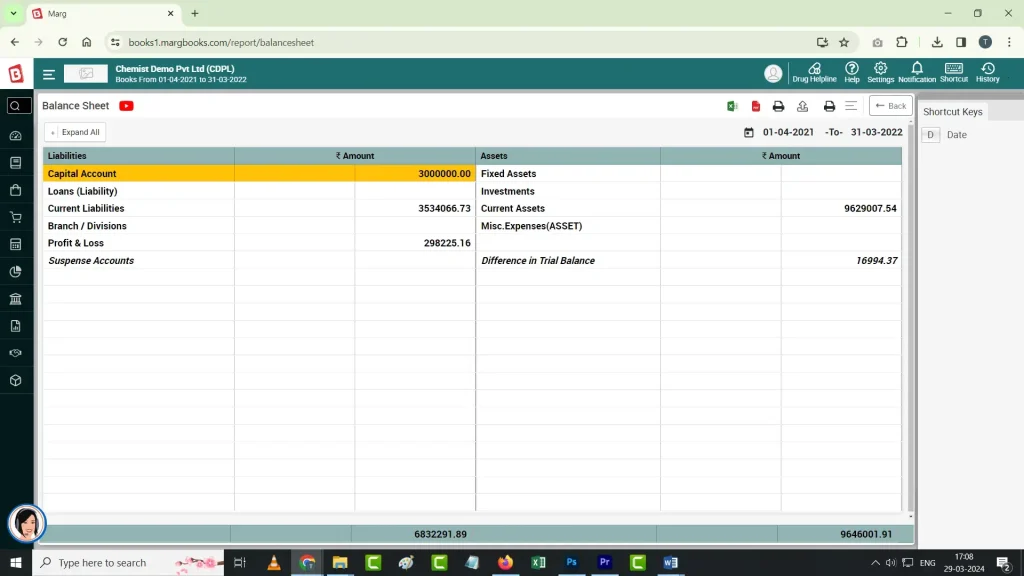

If you’re seeking reputed and advanced balance sheet accounting tools, you can get in touch with MargBooks. Their balance sheet analysis tool includes unmatched features that will also navigate your journey to success

Also Read:

Understanding the Basics of Balance Sheet Structure

How to prepare a balance sheet by month summary?

A Guide to Balance Sheet Formats

Frequently Asked Questions

What Is the Balance Sheet Formula?

The formula for calculating a balance sheet is to balance a company’s assets with its liabilities and equity.

total assets = total liabilities + total equity

Total assets are the sum of short-term, long-term, and other assets. The total liabilities are calculated by summing up all the short-term, long-term, and other liabilities. Total equity is figured out by combining net income, owner contributions, retained earnings, and shares of stock issues.

What Are the Uses of a Balance Sheet?

The balance sheet is an essential financial statement that shows a company’s financial position at a specific point in time. It showcases assets, liabilities, and shareholders’ equity, helping stakeholders in analysing the company’s financial position, liquidity, and solvency. Additionally, it assists in decision-making, financial analysis, and evaluating the company’s ability to meet its short-term and long-term obligations.

Why Is a Balance Sheet Important?

The balance sheet is important to analyse a company’s financial health. The sheet helps ease tax preparation, ensure debtors for loans, show risk and returns, and make informed decisions.

Which is the best balance sheet software?

There are many balance sheet accounting tools, but the top online software for balance sheets is MargBooks which is the first choice of businesses in India. Its features make it the number 1 choice of business persons to ease the whole process.