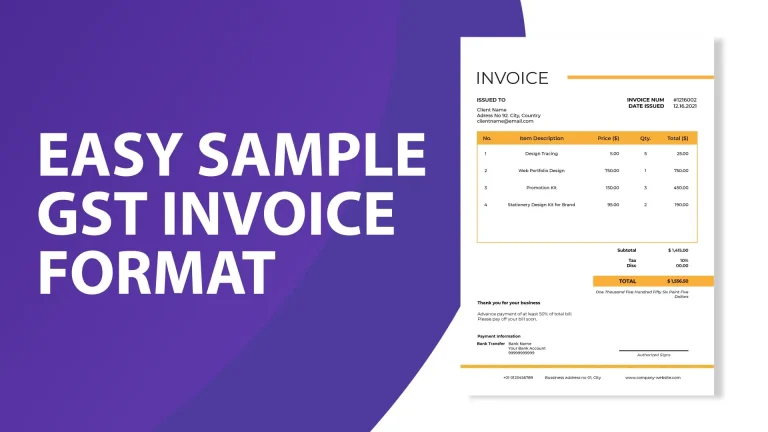

The GST (Goods and Services Tax) invoice stands as a fundamental document. It not only serves as evidence of the sale of goods or services but also plays a crucial role in tax compliance. Discover the sample GST invoice format is essential for businesses to maintain accurate records and comply with GST regulations in India.

Components of a GST Invoice

A GST invoice comprises several key components, each serving a specific purpose in the invoicing process. Let’s delve into these components one by one:

- Invoice Number and Date: Every GST invoice should possess a unique identification number and the date of issuance. This helps in tracking transactions and ensuring chronological order in record-keeping.

- Supplier Details: The invoice must contain the name, address, and GSTIN (Goods and Services Tax Identification Number) of the supplier. This information aids in identifying the party responsible for supplying the goods or services.

- Recipient Details: Similarly, the recipient’s name, address, and GSTIN should be clearly mentioned on the invoice. This facilitates accurate billing and enables recipients to claim input tax credit.

- Description of Goods or Services: A detailed description of the goods or services supplied, including quantity, unit price, and total value, should be provided. This ensures clarity regarding the nature and quantity of the transaction.

- HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) Code: HSN or SAC codes categorize goods and services for taxation purposes. Including these codes on the invoice aids in uniform classification and tax computation.

- Taxable Value and GST Rate: The invoice should specify the taxable value of the goods or services supplied along with the applicable GST rate. This helps in calculating the GST amount payable.

- Tax Amount: The GST amount, comprising CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), IGST (Integrated Goods and Services Tax), and cess (if applicable), should be clearly mentioned.

- Total Amount Payable: Finally, the invoice should display the total amount payable by the recipient, inclusive of all taxes and any other applicable charges.

Importance of Using a Standardized GST invoice template India

Adhering to a standardized GST invoice template India offers several benefits to businesses:

- Compliance with GST Regulations: Using a standardized format ensures compliance with GST laws and regulations, minimizing the risk of penalties or fines for non-compliance.

- Facilitates Input Tax Credit (ITC) Claims: A well-structured invoice containing all necessary details enables recipients to claim input tax credit accurately, thereby reducing their tax liability.

- Enhanced Transparency: Clear and comprehensive invoicing enhances transparency in business transactions, fostering trust between suppliers and recipients.

- Streamlined Taxation Process: Standardized invoices simplify the taxation process for both businesses and tax authorities, reducing the likelihood of errors or discrepancies.

Sample GST Invoice Format (GST Invoice Template India):

| Description | Quantity | Unit Price (₹) | Total (₹) |

|---|---|---|---|

| Product A | 10 | 100 | 1000 |

| Product B | 5 | 150 | 750 |

Utilizing Technology for GST Invoicing

In today’s digital age, businesses have access to a plethora of software solutions and online platforms that simplify the invoicing process and ensure compliance with GST regulations. Here are some ways in which technology can aid in GST invoicing:

- GST Invoicing Software: Dedicated GST invoicing software automates the invoice generation process, allowing businesses to create standardized invoices effortlessly. These software solutions often come equipped with features such as HSN/SAC code lookup, automatic tax calculation, and invoice customization options.

- Integration with Accounting Systems: Many invoicing platforms seamlessly integrate with accounting systems, enabling businesses to maintain accurate financial records and easily reconcile invoices with their accounting books. This integration minimizes manual data entry and reduces the likelihood of errors.

- Real-time GST Updates: Some invoicing software solutions provide real-time updates on changes to GST rates, ensuring that businesses always invoice their goods or services at the correct tax rates. This feature is particularly valuable in an environment where GST rates may undergo frequent revisions.

- Digital Signature Integration: With the advent of digital signatures, businesses can now sign and send GST invoices electronically, eliminating the need for physical paperwork and streamlining the invoicing process. Digital signatures also enhance security and authenticity, reducing the risk of invoice tampering or fraud.

Best Practices for GST Invoicing

To ensure accuracy, compliance, and efficiency in GST invoicing, businesses should adopt the following best practices:

- Regular Training: Train employees involved in the invoicing process on GST regulations, invoice formatting guidelines, and the proper use of invoicing software. Regular training sessions help minimize errors and ensure consistent compliance with GST laws.

- Document Retention: Maintain organized records of all GST invoices, both electronically and in physical form, as per the statutory requirements. Proper document retention facilitates easy retrieval of invoices during tax audits and ensures compliance with record-keeping obligations.

- Periodic Review: Conduct periodic reviews of invoicing processes and templates to incorporate any changes in GST laws or regulations. Stay updated with the latest developments in GST and adjust invoicing practices accordingly to avoid non-compliance issues.

- Customer Communication: Clearly communicate invoice details, including GSTIN, tax rates, and applicable taxes, to customers to facilitate transparency and avoid disputes. Promptly address any queries or concerns raised by customers regarding invoices to maintain positive business relationships.

Mastering the art of GST invoicing is essential for businesses to ensure compliance with GST regulations, facilitate seamless transactions, and enhance transparency in business operations. By understanding the components of a standardized GST invoice, leveraging technology for invoicing purposes, and adhering to best practices, businesses can streamline their invoicing processes and minimize the risk of non-compliance. Remember, accurate and transparent invoicing not only fosters trust with customers but also contributes to the overall efficiency and success of your business.

Also Read:

- Explore About Self Invoice Format Under GSTThe Goods and Services Tax (GST) system in India has brought significant changes to the way businesses handle taxes since it was introduced in July 2017. The main aim of GST is to simplify and unify the complex tax structure… Read more: Explore About Self Invoice Format Under GST

- GST Composition Invoice FormatThe GST (Goods and Services Tax) Composition Scheme is a straightforward and user-friendly taxation scheme designed for small businesses in India. This scheme reduces the compliance burden for small taxpayers by allowing them to pay GST at a fixed rate… Read more: GST Composition Invoice Format

- How Many Times Nil GST Return Acceptable?Goods and Services Tax (GST) is a comprehensive indirect tax that has replaced many other indirect taxes in India. GST applies to the supply of goods and services, making it a critical aspect of business compliance. Among the various types… Read more: How Many Times Nil GST Return Acceptable?

- Difference Between Monthly and Quarterly GST ReturnUnderstanding and complying with Goods and Services Tax (GST) requirements in India involves choosing how often you file your GST returns—monthly or quarterly. This decision is crucial for managing cash flow, meeting compliance obligations, and running your business smoothly. In… Read more: Difference Between Monthly and Quarterly GST Return

Frequently Asked Questions

What is a GST invoice and why is it important?

A GST invoice is a document issued by a seller to a buyer for goods or services sold, including GST details. It’s crucial for tax compliance and input tax credit claims. In India, businesses must maintain accurate GST invoices to adhere to GST regulations.

What are the essential components of a GST invoice?

A GST invoice in India must include details like supplier and recipient information, invoice number and date, description of goods/services, HSN/SAC codes, taxable value, GST rates, and tax amounts. These components ensure clarity and compliance.

Why is it necessary to use a standardized GST invoice format?

Standardized formats ensure uniformity, compliance with regulations, and ease of processing for businesses and tax authorities. It minimizes errors, facilitates input tax credit claims, and enhances transparency in transactions.

How can businesses create a sample GST invoice template in India?

Businesses can design a GST invoice template by incorporating all required components such as supplier/recipients details, invoice number/date, description of goods/services, HSN/SAC codes, and tax details. They can use online templates or customize existing formats to suit their needs.

What are the benefits of utilizing technology for GST invoicing?

Technology streamlines the invoicing process, automating tasks like tax calculation, invoice generation, and integration with accounting systems. It ensures accuracy, compliance, and efficiency, while also offering real-time updates on GST regulations and facilitating digital signatures for electronic invoicing.

How can businesses ensure compliance with GST invoicing regulations?

Businesses can ensure compliance by staying updated with GST laws, training employees on invoicing procedures, using standardized templates, maintaining proper documentation, and conducting periodic reviews of their invoicing processes to incorporate any changes in regulations.

What role do HSN and SAC codes play in a GST invoice?

HSN (Harmonized System of Nomenclature) and SAC (Services Accounting Code) codes classify goods and services for taxation purposes. Including these codes in GST invoices helps in uniform classification, accurate tax calculation, and compliance with GST regulations in India.

Why is it essential to communicate invoice details to customers?

Clear communication of invoice details, including GSTIN, tax rates, and amounts, helps customers understand the transaction and claim input tax credit accurately. It fosters transparency, builds trust, and reduces the likelihood of disputes or errors in invoicing.

How can businesses optimize their GST invoicing processes?

Businesses can optimize their invoicing processes by leveraging technology, standardizing formats, automating repetitive tasks, ensuring data accuracy, and training employees on GST compliance. Regular reviews and updates to invoicing practices also contribute to optimization.

What are the consequences of non-compliance with GST invoicing regulations?

Non-compliance with GST invoicing regulations can result in penalties, fines, and legal consequences for businesses. It may also lead to delays in input tax credit claims, loss of customer trust, and disruptions in business operations. Therefore, adherence to GST laws is crucial for businesses in India.