Creating and using proforma invoices is a common practice in business transactions, especially in India. This guide will provide a comprehensive understanding of the proforma invoice format in India, its importance, and how to effectively create and use one. We’ll cover everything you need to know about proforma invoices, ensuring that you have all the information to make your business dealings smooth and efficient.

What is a Proforma Invoice?

A proforma invoice is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It outlines the terms of the transaction, including the items sold, their quantities, prices, and other essential details. Unlike a regular invoice, a proforma invoice is not a demand for payment. Instead, it serves as a declaration of the seller’s commitment to provide the listed goods or services under the specified conditions.

In simpler terms, a proforma invoice is like a quote or estimate. It shows the buyer what they will get and how much it will cost before the final invoice is issued. It helps both the buyer and seller agree on the details before moving forward with the transaction.

Importance of Proforma Invoice

A proforma invoice is crucial for several reasons:

- Clarity: It provides clarity to the buyer about the goods or services they are purchasing, including detailed descriptions and prices.

- Documentation: It acts as an official document that can be used for various purposes, such as applying for import licenses, opening letters of credit, or simply as part of the sales documentation.

- Estimates: It helps buyers estimate the costs associated with their purchase, including any additional charges such as taxes, shipping, and handling fees.

- Transparency: It ensures transparency between the buyer and seller, reducing the chances of disputes over terms and conditions later on.

Proforma invoices are particularly useful in international trade, where they provide a clear picture of the transaction to all parties involved, including customs authorities. They help in avoiding misunderstandings and ensure that everyone is on the same page regarding the terms of the sale.

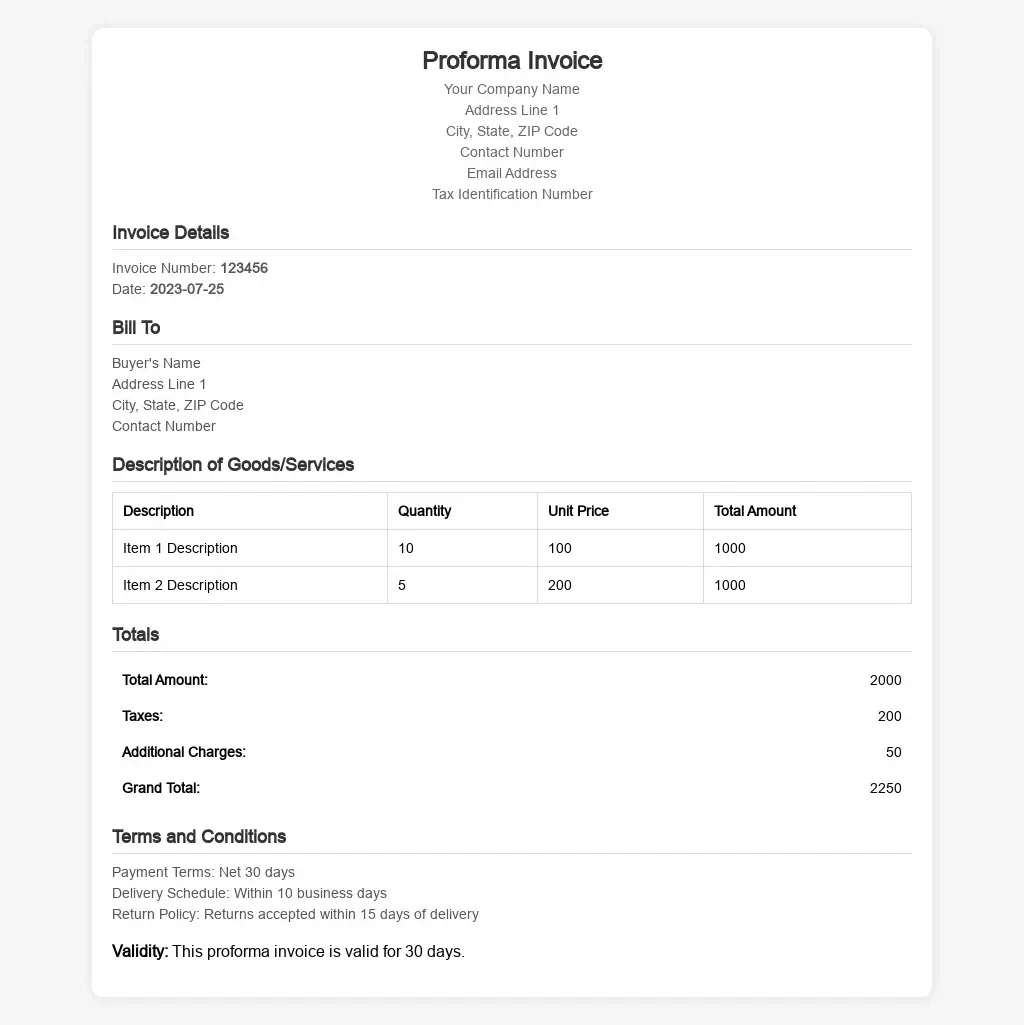

Components of a Proforma Invoice

A well-structured proforma invoice should include the following elements:

- Header: The word “Proforma Invoice” should be clearly stated at the top.

- Seller’s Information: Name, address, contact details, and tax identification number of the seller.

- Buyer’s Information: Name, address, and contact details of the buyer.

- Invoice Number: A unique invoice number for tracking purposes.

- Date: The date the proforma invoice is issued.

- Description of Goods/Services: Detailed descriptions of the items being sold, including quantities and unit prices.

- Total Amount: The total amount payable, including itemized costs, taxes, and any additional charges.

- Terms and Conditions: Any terms and conditions related to the sale, such as payment terms, delivery schedules, and return policies.

- Validity Period: The duration for which the proforma invoice is valid.

These elements ensure that the proforma invoice provides all the necessary information to the buyer. It helps them understand exactly what they are purchasing and under what terms. Including all these details reduces the risk of disputes and helps in smoother transactions.

How to Create a Proforma Invoice

Creating a proforma invoice involves several steps. Here’s a step-by-step guide:

- Use a Template: Start with a proforma invoice template to ensure you include all necessary details.

- Fill in Seller’s Information: Include your business name, address, contact information, and tax identification number.

- Fill in Buyer’s Information: Include the buyer’s name, address, and contact information.

- Assign an Invoice Number: Assign a unique invoice number to the proforma invoice for easy tracking.

- Include Date: Add the date when the invoice is issued.

- List Items: Provide a detailed list of goods or services, including descriptions, quantities, and unit prices.

- Calculate Total: Calculate the total amount, including any taxes and additional charges.

- Add Terms and Conditions: Specify the terms and conditions of the sale, including payment terms and delivery schedules.

- Specify Validity Period: State how long the proforma invoice is valid.

Using a template can simplify the process and ensure that no important details are missed. Many accounting software programs offer templates that you can customize according to your needs. This helps in maintaining consistency and professionalism in your business documentation.

Proforma Invoice Format in India

The format of a proforma invoice in India should comply with local regulations and include all the essential elements mentioned above. Here’s an example of a typical proforma invoice format in India:

|

|||

|

|||

| Description of Goods/Services | Price | ||

| Item 1 Description | ₹10,000.00 | ||

| Item 2 Description | ₹20,000.00 | ||

| Item 3 Description | ₹30,000.00 | ||

| Subtotal: ₹60,000.00 | |||

| Taxes: ₹9,000.00 | |||

| Shipping: ₹2,000.00 | |||

| Grand Total: ₹71,000.00 | |||

– Delivery scheduled within 7-10 business days after payment.

– Goods once sold are not returnable.

– This proforma invoice is valid for 30 days from the date of issue.

Benefits of Using Proforma Invoices

Using proforma invoices offers several benefits for both sellers and buyers:

- For Sellers:

- Helps in outlining the terms of the sale clearly, reducing misunderstandings.

- Acts as a negotiation tool to finalize the terms before issuing a final invoice.

- Facilitates smooth international trade by providing necessary documentation for customs clearance.

- For Buyers:

- Provides a clear estimate of the total cost, helping in budgeting and financial planning.

- Helps in arranging for necessary funds and approvals before the actual transaction.

- Ensures there are no surprises regarding the terms and costs involved.

Proforma invoices are particularly beneficial in large transactions or international trade where clarity and detailed documentation are crucial. They help in ensuring that all parties involved have a clear understanding of the terms and conditions of the sale.

Differences Between Proforma Invoice and Commercial Invoice

While both proforma and commercial invoices serve important roles in the sales process, they have distinct differences:

- Purpose: A proforma invoice is a preliminary document provided before the sale is finalized, while a commercial invoice is the final document issued after the goods or services have been delivered.

- Binding Nature: A proforma invoice is not legally binding and does not require payment, whereas a commercial invoice is legally binding and serves as a request for payment.

- Usage: Proforma invoices are used for quotations and negotiations, whereas commercial invoices are used for customs clearance and accounting purposes.

Understanding these differences is crucial for businesses to use the correct type of invoice at the right stage of the transaction. Using the wrong type of invoice can lead to confusion and potential legal issues.

Common Mistakes to Avoid When Creating a Proforma Invoice

Creating a proforma invoice might seem straightforward, but there are common mistakes that businesses should avoid:

- Incomplete Information: Ensure all necessary details, such as descriptions, quantities, and prices, are included to avoid confusion.

- Incorrect Calculations: Double-check all calculations to ensure the total amount is accurate, including taxes and additional charges.

- Missing Terms and Conditions: Clearly specify payment terms, delivery schedules, and other conditions to avoid disputes.

- Lack of Validity Period: Always mention the validity period of the proforma invoice to indicate how long the offer is valid.

Avoiding these common mistakes can help in creating effective and professional proforma invoices. It ensures that the document serves its purpose of providing clear and detailed information about the transaction.

Proforma Invoice in International Trade

Proforma invoices play a crucial role in international trade. They are used to:

- Facilitate Customs Clearance: Customs authorities use proforma invoices to assess the value of goods for duty and tax purposes.

- Secure Import Licenses: Importers may need a proforma invoice to obtain necessary licenses and permits.

- Arrange Financing: Buyers can use proforma invoices to secure financing from banks or financial institutions.

In international trade, proforma invoices help in ensuring that all regulatory and financial requirements are met before the actual shipment of goods. They provide a clear picture of the transaction to all parties involved, reducing the risk of delays and disputes.

Legal Considerations for Proforma Invoices in India

In India, while proforma invoices are not legally binding, they must still comply with certain regulations:

- GST Compliance: If applicable, the proforma invoice should include details related to Goods and Services Tax (GST).

- Accurate Information: Ensure all information provided is accurate and truthful, as discrepancies can lead to legal complications.

- Record Keeping: Maintain proper records of all proforma invoices issued for audit and reference purposes.

Complying with these legal considerations helps in ensuring that the proforma invoice is valid and can be used for various purposes, including regulatory and financial requirements.

Steps to Convert a Proforma Invoice to a Commercial Invoice

Converting a proforma invoice to a commercial invoice involves a few steps:

- Review the Proforma Invoice: Ensure all details are correct and agreed upon by both parties.

- Finalize the Sale: Once the buyer confirms the order, proceed with fulfilling the order.

- Issue the Commercial Invoice: Use the proforma invoice as a reference to create the final commercial invoice, including any changes or updates.

- Include Payment Terms: Clearly state the payment terms and due date on the commercial invoice.

Following these steps ensures a smooth transition from a proforma invoice to a commercial invoice, facilitating the completion of the sale.

Conclusion

Proforma invoices are an essential tool for businesses, providing clarity and transparency in transactions. By understanding the proforma invoice format in India, businesses can create accurate and professional documents that help in smooth and efficient transactions. Whether used for domestic or international trade, proforma invoices play a crucial role in ensuring that both buyers and sellers have a clear understanding of the terms and conditions of the sale.

Also Read

- What Are the Benefits of Automating e Invoice in GST for Multi-Store Businesses?Running multiple outlets isn’t a walk in the park, especially when GST filings, billing, and stock tracking start piling up. This is where e invoice in GST becomes more than just a legal mandate. It turns into a smart business… Read more: What Are the Benefits of Automating e Invoice in GST for Multi-Store Businesses?

- Why Should You Upgrade to an e Billing System Before Year-End?If you’re still juggling paper bills, Excel sheets, or clunky offline tools, it’s time to rethink. An e billing system isn’t just about digital bills, it’s about gaining control before the financial year wraps up. For Indian businesses, this means… Read more: Why Should You Upgrade to an e Billing System Before Year-End?

- How Does the Difference Between Money Bill and Finance Bill Affect Billing Software?In the world of finance and governance, we often hear terms like Money Bill and Finance Bill being used, especially around budget sessions in the Parliament. But have you ever wondered how these bills, which are essentially legislative tools, impact… Read more: How Does the Difference Between Money Bill and Finance Bill Affect Billing Software?

- Which Accounting Software is Best for Handling the Bill of Supply Under GST?Managing compliance under the Goods and Services Tax (GST) regime is no easy task, especially when it comes to documentation like the Bill of Supply under GST. Whether you’re a small business owner, freelancer, or a dealer under the Composition… Read more: Which Accounting Software is Best for Handling the Bill of Supply Under GST?

- How Does an Electronic Invoicing System Ensure Faster GST Compliance?Running a business in India means dealing with GST returns every month. If you’re still managing invoices manually or using basic spreadsheets, you’re probably spending way too much time on compliance tasks. An electronic invoicing system changes everything by automating… Read more: How Does an Electronic Invoicing System Ensure Faster GST Compliance?

Frequently Asked Questions

What is a proforma invoice and why is it used?

A proforma invoice is a preliminary bill of sale sent to buyers before a shipment or delivery of goods. It outlines the items sold, quantities, prices, and terms of the transaction. Unlike a regular invoice, it is not a demand for payment. It serves as an agreement between the buyer and seller, ensuring both parties are clear on the details of the sale. This helps avoid misunderstandings and disputes, making the transaction process smoother and more transparent.

How does a proforma invoice differ from a commercial invoice?

A proforma invoice is a preliminary document sent before the final sale, serving as a commitment from the seller. It outlines the terms but is not a demand for payment. A commercial invoice, on the other hand, is issued after the goods or services are delivered and serves as a request for payment. The commercial invoice is legally binding and used for customs clearance and accounting purposes, whereas the proforma invoice is mainly for quotations and negotiations.

What details must be included in a proforma invoice in India?

A proforma invoice in India should include the seller’s and buyer’s information, a unique invoice number, date of issue, detailed description of goods or services, quantities, unit prices, total amount, taxes, additional charges, and terms and conditions. It should also specify the validity period of the invoice. Including all these details ensures that the proforma invoice provides clear and comprehensive information, helping to avoid misunderstandings and disputes between the buyer and seller.

Can a proforma invoice be used for customs clearance in India?

Yes, a proforma invoice can be used for customs clearance in India. It provides customs authorities with a clear outline of the goods being imported, including their value, quantity, and terms of sale. This helps in assessing duties and taxes. However, a commercial invoice is usually required for final customs clearance. The proforma invoice acts as a preliminary document, ensuring that all parties, including customs, are aware of the transaction details before the actual shipment.

How do you convert a proforma invoice into a commercial invoice?

To convert a proforma invoice into a commercial invoice, review and finalize the details in the proforma invoice. Ensure both parties agree on the terms. Once confirmed, create a commercial invoice using the proforma as a reference, updating any necessary information. Include payment terms and due dates. Issue the commercial invoice to the buyer after the goods or services are delivered. This final invoice is legally binding and serves as a request for payment.

Is a proforma invoice legally binding in India?

No, a proforma invoice is not legally binding in India. It is a preliminary document used to outline the terms of a transaction before the final sale. It serves as an agreement between the buyer and seller but does not require payment. The commercial invoice, issued after the goods or services are delivered, is the legally binding document. The proforma invoice helps in ensuring that both parties are clear on the transaction details, reducing the risk of disputes.

What are the benefits of using a proforma invoice for sellers?

For sellers, using a proforma invoice provides several benefits. It helps outline the terms of the sale clearly, reducing misunderstandings. It serves as a negotiation tool to finalize terms before issuing a final invoice. It facilitates smoother international trade by providing necessary documentation for customs clearance. Additionally, it helps sellers in planning and managing inventory and production schedules, ensuring that they can meet the agreed terms and delivery timelines efficiently.

How long is a proforma invoice valid in India?

The validity period of a proforma invoice in India varies depending on the seller’s terms and the nature of the transaction. Typically, it ranges from 30 to 90 days. This period should be clearly mentioned on the proforma invoice. The validity period ensures that the buyer has a specific timeframe to confirm the order based on the quoted prices and terms. After this period, the terms may need to be renegotiated, as prices or availability might change.

Can a buyer make payments based on a proforma invoice?

While a proforma invoice is not a demand for payment, a buyer can make advance payments based on it if agreed upon with the seller. This is common in international trade, where advance payments are made to secure orders. The proforma invoice provides the necessary details for the buyer to arrange funds. However, the final payment is usually made based on the commercial invoice issued after the goods or services are delivered. The proforma invoice helps in ensuring that both parties agree on the transaction details before proceeding.

Are proforma invoices mandatory for all transactions in India?

No, proforma invoices are not mandatory for all transactions in India. They are commonly used in international trade and in cases where a preliminary document is needed to outline the terms of a sale before the final invoice is issued. While not legally required, they are beneficial for providing clarity and transparency in transactions. They help in ensuring that both the buyer and seller agree on the terms before proceeding, reducing the risk of disputes and misunderstandings.