In today’s busy world of business, being efficient is super important. One big thing that needs to be super efficient is billing. With new technology, old-fashioned manual billing is out of date and can make a lot of mistakes. That’s where GST invoice software comes in handy. It totally changes the way businesses handle their billing stuff.

Understanding GST Invoice Software

GST invoice software is a special tool made to make invoicing easy for businesses in countries with Goods and Services Tax (GST) systems. These software tools are made to fit the special rules of GST so businesses can make invoices that are right and follow all the rules.

Key Features of GST Invoice Software

- Making Invoices: The main job of GST invoice software is to make invoices fast and right. With just a few clicks, businesses can make invoices for things they sold, with all the details like what they sold, how much, how much it costs, and the taxes.

- Following GST Rules: Following GST rules is super important. GST invoice software does the math for businesses, so they don’t have to worry about getting the taxes right. This makes sure the invoices follow the law and businesses don’t get in trouble.

- Making it Special: Every business is different. GST invoice software lets businesses make their invoices look the way they want. They can add their logo, change how it looks, and even add a message to make it special and show off their brand.

- Keeping Track of Stuff: Some GST invoice software also helps with keeping track of what’s in stock. This helps businesses know what they have, what’s selling, and what they might need to order more of.

- Knowing Who Paid: Keeping track of payments is super important for making sure the money keeps coming in. GST invoice software helps businesses record when they get paid, see who hasn’t paid yet, and even remind them if they forget.

- Getting Smart with Data: Knowing what’s going on in the business is really helpful. GST invoice software can make reports and charts to show businesses what’s selling, who’s buying, and how much money they’re making. This helps businesses make good decisions to grow.

Benefits of Using GST Invoice Software

- Saving Time: By doing the boring invoicing stuff automatically, GST invoice software gives businesses more time to focus on the fun stuff. This means they can get more done and make more money.

- Getting it Right: Making mistakes on invoices can be a big problem. GST invoice software makes sure everything adds up right, so businesses don’t lose money because of silly mistakes.

- Saving Money: Even though buying software costs money, using GST invoice software saves businesses money in the long run. It helps them work better, make fewer mistakes, and manage money better.

- Looking Professional: Sending out nice-looking invoices makes a business look good. GST invoice software helps make invoices that look professional, which makes customers happy and more likely to come back.

- Growing with the Business: As a business gets bigger, it needs more invoices. GST invoice software can handle more invoices without any problems, so businesses can grow without worrying about their billing.

Choosing the Right Software

When it comes to choosing the right GST invoice software for your business, there are a few things to consider. Firstly, look for software that is user-friendly and easy to navigate. You don’t want to spend hours trying to figure out how to use it. Instead, opt for software with a clean interface and intuitive features that make invoicing a breeze.

Secondly, consider your specific business needs. Do you need software that integrates with your existing accounting system? Are you looking for additional features such as inventory management or customer relationship management (CRM) integration? Make a list of must-have features and prioritize them when evaluating different software options.

Thirdly, think about scalability. As your business grows, you’ll need software that can grow with you. Choose a solution that can accommodate increasing invoicing volumes and expanding business operations without compromising performance or efficiency.

Lastly, consider the cost. While investing in GST invoice software can save you time and money in the long run, you’ll still want to ensure that you’re getting good value for your money. Look for software that offers a reasonable price point and consider factors such as setup fees, subscription plans, and any additional costs for extra features or support.

Tips for Using GST Invoice Software Effectively

Once you’ve chosen the right GST invoice software for your business, here are some tips for using it effectively:

- Set Up Properly: Take the time to set up your software correctly from the start. This includes inputting accurate business information, setting up tax rates, customizing invoice templates, and integrating with any other relevant systems.

- Train Your Team: Make sure your team members are properly trained on how to use the software. Provide them with training sessions or tutorials to familiarize them with the features and functionalities.

- Regular Updates: Keep your software up to date with the latest updates and patches. This ensures that you have access to new features, bug fixes, and security enhancements.

- Backup Your Data: Regularly backup your invoicing data to prevent loss in case of system failures or data breaches. Most GST invoice software solutions offer built-in backup features or integrate with cloud storage services for added security.

- Monitor Performance: Keep an eye on how your software is performing. Monitor metrics such as invoice processing time, payment collection rates, and customer satisfaction to identify areas for improvement.

- Seek Support When Needed: If you encounter any issues or have questions about using the software, don’t hesitate to reach out to the vendor’s customer support team for assistance. They’re there to help you get the most out of your software investment.

Best GST Invoice Software:

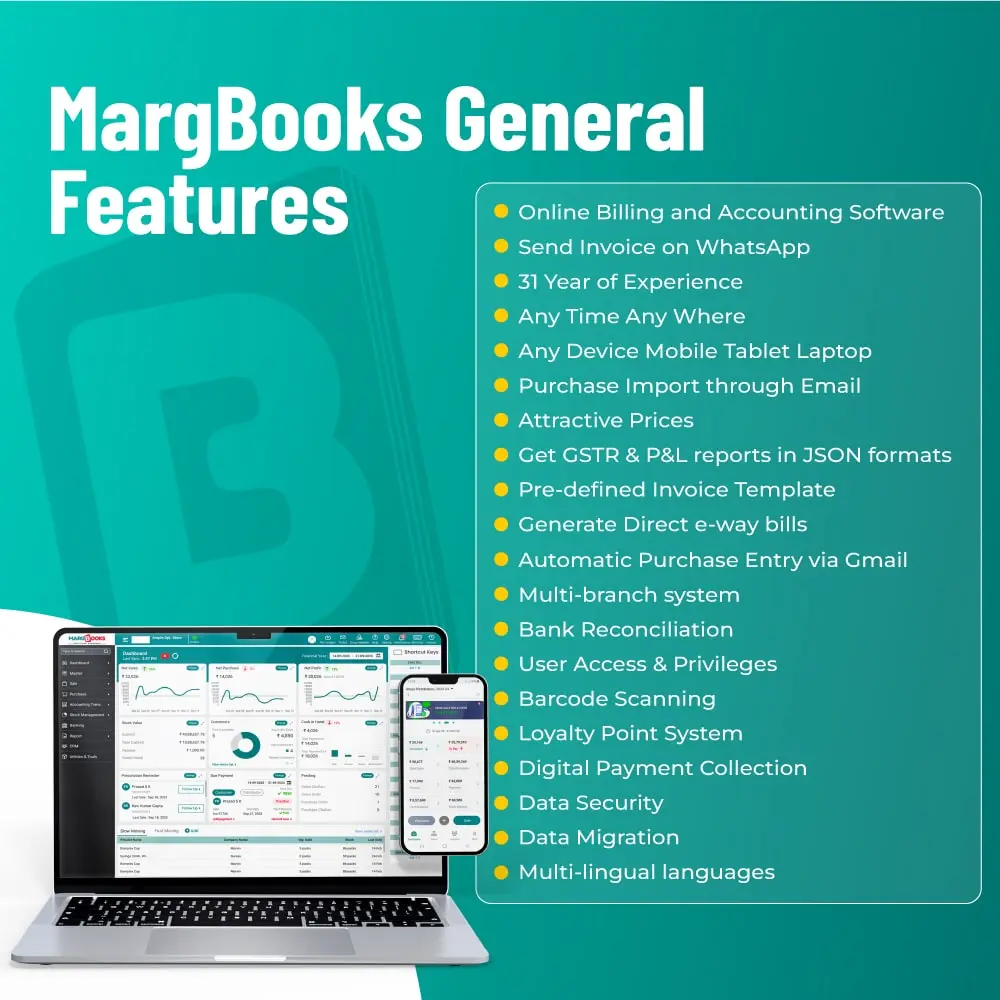

MargBooks stands out as a premier GST invoice software solution, offering a comprehensive suite of features designed to streamline your billing and accounting processes. With over 31 years of experience in the industry, MargBooks has established itself as a trusted partner for businesses of all sizes.

Key Features of MargBooks Software

- Online Billing and Accounting: MargBooks provides a seamless online platform for billing and accounting, allowing you to manage your finances from anywhere, anytime, and on any device – be it your mobile, tablet, or laptop.

- WhatsApp Integration: Stay connected with your customers by sending invoices directly via WhatsApp, making communication quick and convenient.

- Purchase Import via Email: Simplify the procurement process by importing purchase orders directly through email, reducing manual data entry and saving time.

- Attractive Pricing: MargBooks offers competitive pricing plans tailored to meet the needs and budgets of businesses across various industries.

- GSTR & P&L Reports in JSON Format: Stay compliant with GST regulations and gain valuable insights into your financial performance with detailed GSTR and Profit & Loss reports in JSON format.

- Pre-defined Invoice Templates: Choose from a variety of pre-defined invoice templates to create professional-looking invoices that reflect your brand identity.

- E-way Bill Generation: Generate e-way bills directly from the software, simplifying the process of transporting goods and ensuring compliance with GST requirements.

- Automatic Purchase Entry via Gmail: MargBooks automates the entry of purchase transactions by integrating with Gmail, making data entry effortless and error-free.

- Multi-Branch System: Manage multiple branches or locations seamlessly within the software, consolidating data and improving operational efficiency.

- Bank Reconciliation: Reconcile your bank transactions effortlessly, ensuring accuracy and transparency in your financial records.

- User Access & Privileges: Control access to sensitive information by assigning user roles and privileges, ensuring data security and confidentiality.

- Barcode Scanning: Streamline inventory management and sales processes with barcode scanning capabilities, reducing errors and improving efficiency.

- Loyalty Point System: Reward your loyal customers and encourage repeat business with a built-in loyalty point system, enhancing customer satisfaction and retention.

- Digital Payment Collection: Accept digital payments seamlessly through integrated payment gateways, offering convenience to your customers and improving cash flow.

- Data Security: MargBooks prioritizes the security of your data, implementing robust measures to safeguard against unauthorized access and data breaches.

- Data Migration: Easily migrate your existing data to MargBooks, ensuring a smooth transition without any loss of information or disruption to your operations.

- Multi-lingual Support: MargBooks supports multiple languages, catering to users across different regions and linguistic preferences.

With its extensive range of features and user-friendly interface, MargBooks empowers businesses to manage their billing and accounting processes efficiently, saving time, reducing errors, and driving growth. Experience the convenience and reliability of MargBooks for your business today!

Also Read:

- What is Goods and Service Tax (GST)?Let’s discuss Goods and Service Tax (GST). In India, GST affects most purchases or sales made. Imagine it as an added fee on everyday items we use like groceries. This is essential both to businesses as well as everyday people… Read more: What is Goods and Service Tax (GST)?

- A Simple Guide to Making a Board Resolution for GST RegistrationRegistering for Goods and Services Tax (GST) is an essential step for businesses in India. This step not only ensures compliance with the law but also boosts the credibility of a business and opens up broader opportunities. One important part… Read more: A Simple Guide to Making a Board Resolution for GST Registration

- Decoding GST on Stamp Duty: A Step-by-Step GuideUnderstanding how GST (Goods and Services Tax) and stamp duty work together can be quite challenging. Both are very important parts of the Indian taxation system and have a significant impact on various financial transactions, especially in the real estate… Read more: Decoding GST on Stamp Duty: A Step-by-Step Guide

- The ABCs of Account Accounting & Inventory System with GST ComplianceIn today’s fast-paced business world, keeping track of money and goods is crucial. That’s where an account accounting and inventory management system with GST compliance comes in. Let’s break down what it is, why it’s essential, and why using a… Read more: The ABCs of Account Accounting & Inventory System with GST Compliance

Frequently Asked Questions

What is GST invoice software?

GST invoice software is a specialized tool designed to streamline the invoicing process for businesses operating in countries with Goods and Services Tax (GST) systems.

How does GST invoice software simplify billing?

It automates invoicing tasks, calculates taxes accurately, ensures compliance with GST regulations, and provides features like inventory management and payment tracking, saving time and reducing errors.

Can I customize my invoices with GST invoice software?

Yes, you can personalize invoice templates, add your company logo, and include custom messages to reflect your brand identity and professionalism.

Is GST invoice software suitable for small businesses?

Absolutely! GST invoice software caters to businesses of all sizes, offering scalable solutions to meet their invoicing needs efficiently.

How does GST invoice software handle GST compliance?

It automatically calculates GST amounts based on predefined tax rates, ensuring that invoices are compliant with tax laws and regulations.

Can I access GST invoice software from anywhere?

Yes, MargBooks GST invoice software solutions offer online access, allowing you to manage your invoicing tasks from anywhere, anytime, and on any device with an internet connection.

Does GST invoice software offer reporting capabilities?

Yes, GST invoice software provides reporting and analytics features that offer insights into sales trends, customer behavior, and financial performance, empowering informed decision-making.

Is data security ensured with GST invoice software?

Absolutely, GST invoice software prioritizes data security, implementing robust measures to safeguard against unauthorized access and data breaches.

Can GST invoice software integrate with other systems?

Yes, MargBooks GST invoice software solutions offer integration capabilities with accounting, inventory management, and CRM systems, enabling seamless data flow across platforms.

How can I get started with GST invoice software?

Simply choose a reputable GST invoice software provider like MargBooks, sign up for their services, and follow their onboarding process to start simplifying your billing process today.