If you run a business that involves interstate transactions in India, understanding how to create an IGST invoice is very important. IGST stands for Integrated Goods and Services Tax, and it applies when goods or services are sold between different states. In this blog, we will explain everything you need to know about creating an IGST invoice format using simple words.

We’ll go through each part of the invoice and guide you on how to fill it out correctly, step by step.

What is IGST?

IGST (Integrated Goods and Services Tax) is one of the main types of taxes under India’s GST system. It is applied when goods or services are sold from one state to another. For example, if a company in Maharashtra sells goods to a company in Tamil Nadu, IGST will be charged on that sale.

IGST is important because it helps manage how tax money is shared between the central government and the state where the sale happens. Unlike CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax), which are used for sales within a single state, IGST is only used for interstate sales.

Why is an IGST Invoice Important?

Creating an IGST invoice is a legal requirement for any business involved in interstate transactions. A proper IGST invoice helps you:

- Record sales accurately.

- Calculate taxes correctly.

- Comply with GST regulations.

- Avoid penalties and legal issues.

A well-organized invoice also helps maintain good business relationships with your clients and ensures smooth tax filing. If you don’t create the right invoice, it may cause problems with tax authorities and hurt your business reputation.

Key Parts of an IGST Invoice Format

Now, let’s go over the main sections that must be included in an IGST invoice format. Each part serves a specific purpose and must be filled out carefully.

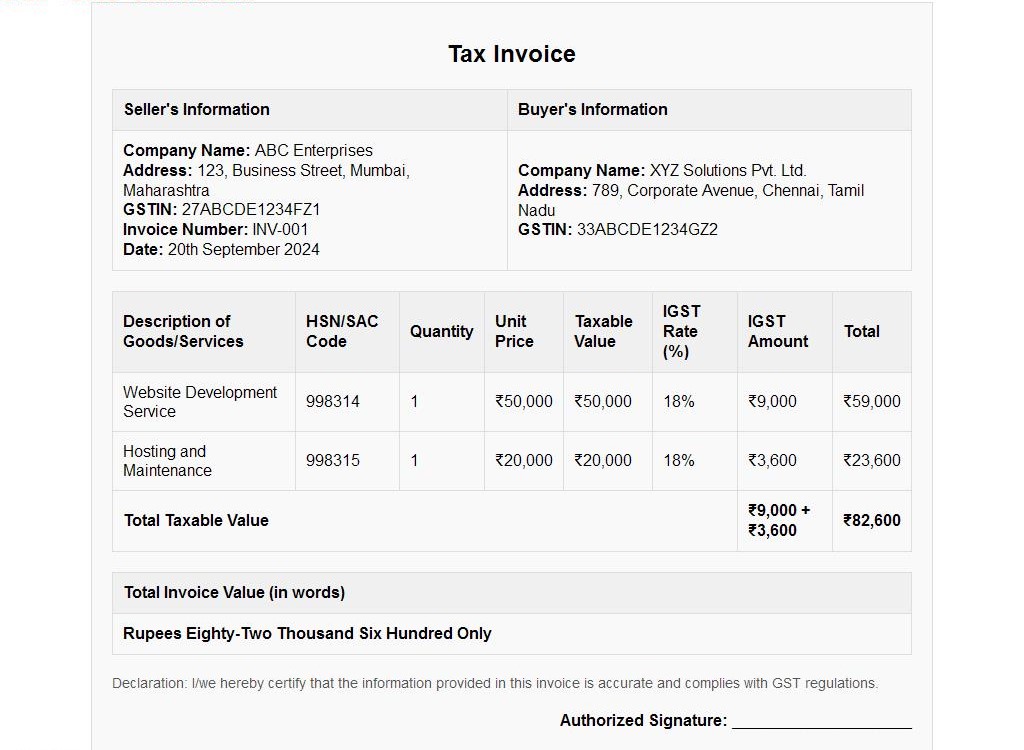

1. Invoice Title and Number

At the top of the invoice, you need to clearly mention the words “Tax Invoice.” You should also assign a unique invoice number. The invoice number must follow a sequence and should not be repeated. Along with this, add the date when the invoice is issued.

2. Seller’s Information

This section includes details about the seller (your business). You need to provide:

- Business name.

- Registered address.

- GSTIN (Goods and Services Tax Identification Number).

Your GSTIN is a unique number that identifies your business under the GST system. Make sure it’s correct because this is an important detail.

3. Buyer’s Information

Next, you’ll need to add the buyer’s details. This includes:

- Buyer’s name.

- Buyer’s address.

- Buyer’s GSTIN (if they are registered under GST).

Just like the seller’s GSTIN, the buyer’s GSTIN should also be accurate.

4. Description of Goods or Services

In this section, describe what you are selling. This could be products or services. Include:

- Name or description of the goods/services.

- Quantity.

- Unit price.

- Total value (before tax).

This section allows both parties (you and your customer) to clearly understand what is being sold and how much it costs.

5. HSN or SAC Code

Every product or service under the GST system has a unique code. These codes help the tax authorities identify the type of goods or services being sold.

- HSN Code is used for goods.

- SAC Code is used for services.

Make sure to include the correct HSN or SAC code for what you are selling.

6. Taxable Value

This is the total amount of the sale, excluding taxes. It is calculated by multiplying the quantity by the unit price. For example, if you are selling 100 units of a product that costs ₹50 per unit, the taxable value will be ₹50 x 100 = ₹5000.

7. IGST Rate and Amount

This is one of the most important parts of the IGST invoice format. Here, you need to mention the IGST rate that applies to your product or service. The IGST rate is different for different types of products or services, so make sure you apply the correct rate.

Once you know the IGST rate, you can calculate the IGST amount by multiplying the taxable value by the IGST rate.

For example:

- If the taxable value is ₹10,000 and the IGST rate is 18%, the IGST amount will be: ₹10,000 x 18% = ₹1,800.

8. Total Invoice Value

The total invoice value is the sum of the taxable value and the IGST amount. This is the total amount that the buyer needs to pay. Make sure to mention this amount clearly in both numbers and words.

For example:

- Total Invoice Value: ₹11,800 (Rupees Eleven Thousand Eight Hundred Only).

9. Payment Terms (Optional)

If you have any specific payment terms, you can mention them here. This may include:

- The due date for payment.

- Accepted payment methods (e.g., bank transfer, cheque, etc.).

- Any penalties for late payment or discounts for early payment.

10. Declaration

In this section, you can add a standard declaration. This is a statement that confirms the details of the invoice are correct. For example, you can write:

“I declare that the information given in this invoice is accurate and true to the best of my knowledge.”

11. Authorized Signature

Finally, the invoice should be signed by an authorized person from your business. This could be the owner, director, or any person authorized to issue invoices. A signature is a must to make the invoice official.

How To Create an IGST Invoice – Step by Step

Creating an IGST invoice format may seem complicated, but if you follow a simple process, it becomes easy. Here’s a step-by-step guide:

Step 1: Choose an Invoice Template

Start by choosing an invoice template. You can find many free templates online, or you can use accounting software like MargBooks to create a professional invoice. Make sure the template includes all the important sections we discussed earlier.

Step 2: Fill in Seller and Buyer Information

Enter the details of the seller (your business) and the buyer. Double-check the GSTINs of both parties to avoid any mistakes. If the buyer is not registered under GST, you can skip the GSTIN for the buyer.

Step 3: Add the Description of Goods or Services

List the items being sold, along with their quantity, unit price, and total value. Make sure to add the HSN or SAC code for each item. This helps ensure compliance with GST regulations.

Step 4: Apply the Correct IGST Rate

Check the IGST rate that applies to your goods or services. Once you know the rate, calculate the IGST amount by applying the rate to the taxable value. Include this information in a separate section of the invoice.

Step 5: Calculate the Total Invoice Value

Finally, calculate the total invoice value by adding the taxable value and the IGST amount. Mention this total clearly on the invoice.

Step 6: Review and Sign the Invoice

Before sending the invoice to the buyer, review all the details to make sure they are correct. Once everything is in order, sign the invoice or add a digital signature if you are sending it electronically.

Best Practices for Creating IGST Invoices

To ensure that your IGST invoices are always accurate and compliant, here are some best practices to follow:

- Use Software: Using accounting software like MargBooks can make the process of creating invoices faster and easier. It also helps avoid errors when calculating taxes.

- Verify GSTINs: Always double-check the GSTINs of both the seller and the buyer before issuing the invoice. Incorrect GSTINs can cause problems during tax filing.

- Issue Timely Invoices: Ensure that invoices are issued promptly after the sale or service. Delays can complicate tax filings and cause penalties.

- Keep Records: Maintain proper records of all invoices for future reference or audits. This can help in case of any discrepancies or tax reviews.

Also Read

- What Details Must be Included in a Sale Bill with GST?Getting your GST paperwork wrong feels like walking through a minefield, doesn’t it? One missing detail on your invoices, and suddenly you’re dealing with compliance headaches that could’ve been easily avoided. Creating a proper Sale Bill with GST isn’t… Read more: What Details Must be Included in a Sale Bill with GST?

- How Is a Purchase Bill with GST Different from a Sales Invoice?Running a business in today’s GST-enabled economy requires more than just selling and buying. It’s about being organised, compliant, and aware of what each document in your billing system stands for. One common confusion many businesses face is the… Read more: How Is a Purchase Bill with GST Different from a Sales Invoice?

- How Can You Generate a Mobile GST Bill in Seconds?Running a shop is hard enough. But when billing takes forever and GST compliance gets messy, things can slow down. That’s where a Mobile GST Bill comes to the rescue. Whether you run a busy garment store or a… Read more: How Can You Generate a Mobile GST Bill in Seconds?

- What Happens If GST on Advance Received Is Not Paid on Time?Running a business in India requires keeping pace with ever-evolving tax laws, and GST in advance is one such area that many businesses often overlook sometimes unintentionally. But missing out on timely GST payment on advances can lead to… Read more: What Happens If GST on Advance Received Is Not Paid on Time?

- How Does the 9988 HSN Code Impact GST Filing for Businesses?Navigating the complexities of GST can be daunting, especially for service-based businesses in India. Among the many elements of GST compliance, the HSN (Harmonised System of Nomenclature) code plays a crucial role in categorising goods and services. One such… Read more: How Does the 9988 HSN Code Impact GST Filing for Businesses?

Frequently Asked Questions

What is an IGST invoice format?

An IGST invoice format is a template used to create invoices for transactions between different states in India. It includes details like the seller’s and buyer’s information, the goods or services sold, the IGST rate, and the total amount. This format ensures compliance with GST rules for interstate sales.

Why is an IGST invoice needed?

An IGST invoice is needed to accurately record interstate transactions and calculate the correct tax. It helps businesses comply with GST regulations and ensures that the correct amount of IGST is collected and reported to tax authorities.

What details are required on an IGST invoice?

An IGST invoice should include the invoice title, date, unique invoice number, seller’s and buyer’s details, description of goods or services, HSN or SAC code, taxable value, IGST rate and amount, total invoice value, and payment terms.

How do I calculate IGST on an invoice?

To calculate IGST, multiply the taxable value of the goods or services by the applicable IGST rate. For example, if the taxable value is ₹10,000 and the IGST rate is 18%, the IGST amount will be ₹1,800 (₹10,000 x 18%).

What is HSN/SAC code in an IGST invoice?

The HSN (Harmonized System of Nomenclature) code is used for goods, and the SAC (Service Accounting Code) is used for services. These codes help classify items for taxation purposes and should be included on the IGST invoice.

Can I use an accounting software for IGST invoices?

Yes, using accounting software like MargBooks can simplify the creation of IGST invoices. The software can automatically apply the correct tax rates, calculate totals, and help you generate compliant invoices quickly and accurately.

What should be included in the payment terms section?

The payment terms section should include the due date for payment, accepted payment methods (such as bank transfer or cheque), and any discounts for early payment or penalties for late payment. It helps set clear expectations for payment.

How do I ensure my IGST invoice is compliant?

To ensure compliance, include all required details such as GSTINs, correct HSN/SAC codes, and accurate tax calculations. Regularly review GST regulations to stay updated on any changes and use reliable accounting software for accuracy.

What happens if I make a mistake on an IGST invoice?

If you make a mistake on an IGST invoice, you should issue a revised invoice with the correct details. Inform the buyer about the correction and keep a record of both the original and revised invoices for your records and tax filing.

How long should I keep IGST invoices?

You should keep IGST invoices for at least 6 to 8 years. This is important for tax purposes, audits, and record-keeping. Proper storage ensures that you have all necessary documents available if required by tax authorities.