A commercial invoice is an important document used in business, especially when buying and selling goods internationally. It acts as proof of the sale between the buyer and seller. This document includes details about the products being sold, the price, and how they will be delivered. We will explain how to create a commercial invoice format, what to include in it, and why it’s important. We’ll keep the language simple and professional to help you understand how to make a clear, detailed invoice that will benefit your business.

What is a Commercial Invoice?

A commercial invoice is a document that shows the agreement between the buyer and seller. It provides information about the products, the price, and how the payment will be made. It’s also required when shipping goods internationally to ensure smooth customs clearance.

Some key reasons why a commercial invoice is important:

- Record Keeping: It helps track the details of each transaction.

- Customs Clearance: For international shipments, the invoice is used by customs to determine taxes and duties.

- Payment: It provides the details needed to complete payments between businesses.

Why is a Commercial Invoice Important?

A commercial invoice is important for both local and international trade for the following reasons:

- Proof of Sale: It confirms that a sale took place between the buyer and seller.

- Customs Use: Customs offices need this document to figure out taxes and duties on goods that are shipped across borders.

- Payments: Buyers often need this document to arrange payments, and it helps in handling transactions securely.

- Business Records: It helps businesses keep track of their sales and earnings for tax and accounting purposes.

Key Parts of a Commercial Invoice Format

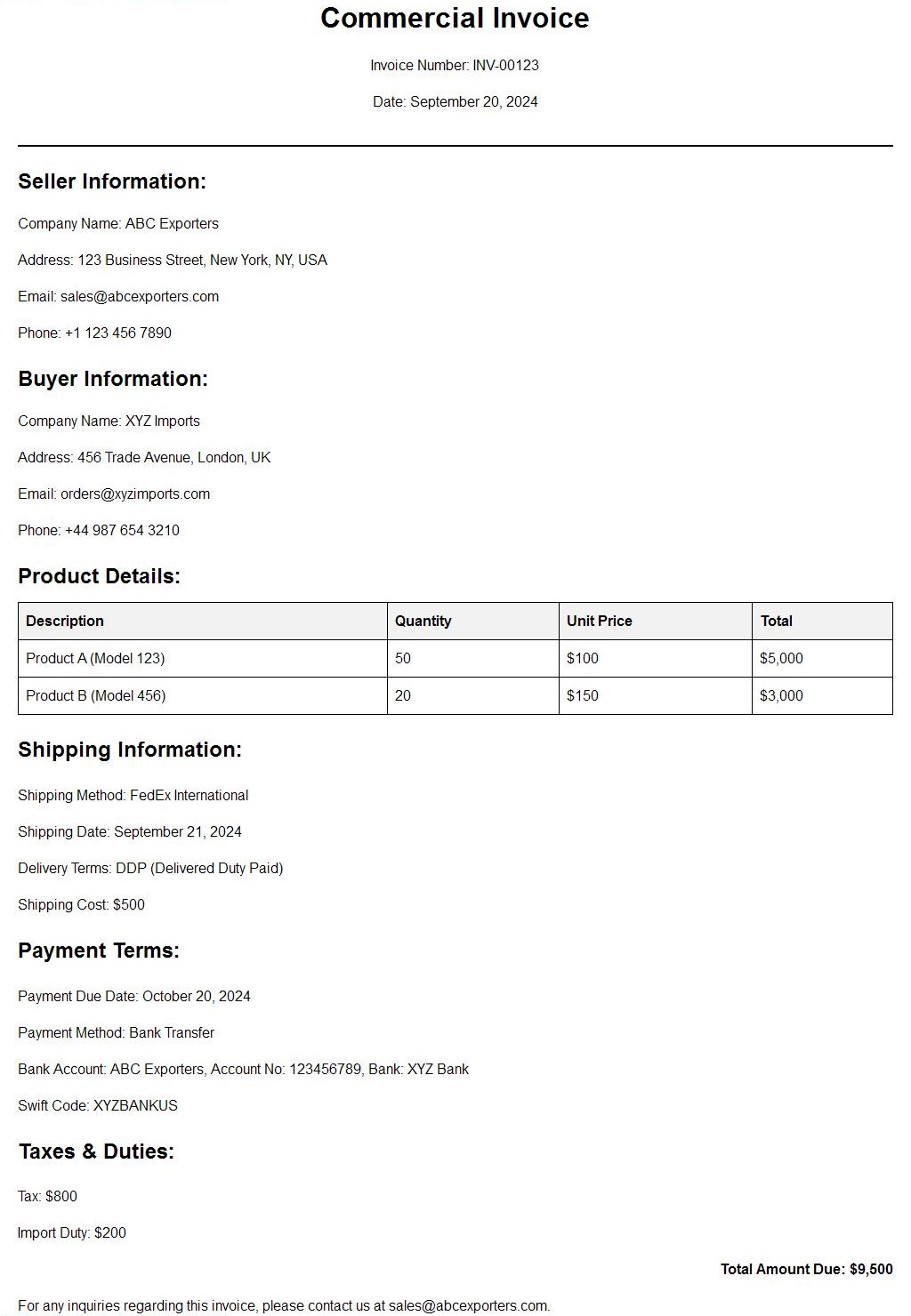

To create a professional commercial invoice format, you need to include several key sections. Here’s a breakdown of what to include:

1. Buyer and Seller Information

Both the seller’s and buyer’s names, addresses, and contact information should be clearly stated. This ensures that the invoice can be easily traced back to the right parties.

2. Invoice Number

Each invoice should have a unique number. This helps both the buyer and seller track the specific transaction in their records.

3. Invoice Date

This is the date when the invoice was issued. It helps both parties know when the payment is due.

4. Product or Service Details

List the products or services being sold. Provide a description for each item, the quantity, and the price for each unit. This section needs to be clear to avoid confusion.

5. Price Breakdown

For each product, mention the price per unit and calculate the total price. Be clear about the final amount the buyer needs to pay.

6. Currency

Specify the currency in which the payment will be made, like USD, EUR, or INR. This is important, especially in international trade, where different currencies are used.

7. Payment Terms

Clearly mention when the payment is due. Common terms are “Net 30,” which means the payment is due in 30 days. You can also mention penalties for late payments or any discounts for early payments.

8. Shipping Information

Include details about how and when the products will be shipped, and who is responsible for any shipping costs.

9. Taxes and Fees

If any taxes or additional fees apply, list them separately. This helps the buyer understand the final cost.

10. Total Amount Due

This is the final total the buyer must pay. It should include the product costs, shipping, and any taxes or fees.

Step-by-Step Guide to Creating a Commercial Invoice Format

Creating a commercial invoice is straightforward when you follow these steps:

Step 1: Choose a Template

There are many free or paid templates available online. Using a template will help you maintain a professional look and ensure that you don’t forget any important details.

Step 2: Enter Seller and Buyer Details

Start by adding the full names, addresses, and contact details of both the buyer and the seller. Make sure this information is accurate to avoid any issues with payment or shipping.

Step 3: Add Invoice Number and Date

Assign a unique invoice number to each invoice, and include the date it was created. This makes it easy to organize and track your invoices.

Step 4: List Products or Services

Include each product or service in detail, mentioning the quantity, description, and unit price. This helps the buyer understand what they are paying for.

Step 5: Mention Payment Terms

Include payment terms such as the due date and any penalties for late payment. This will help you avoid delays and ensure you get paid on time.

Step 6: Calculate the Total Cost

Add up the price of all products, include any applicable taxes or shipping fees, and clearly state the total amount due. This makes it clear what the buyer needs to pay.

Step 7: Double-Check for Accuracy

Before sending the invoice, review all the details to make sure everything is correct. Errors can lead to delays in payment or shipment.

Tips for Creating a Professional Commercial Invoice Format

Here are some tips to make your commercial invoice format more professional and effective:

1. Keep It Simple and Clear

Make sure the most important details, like the total amount due and payment terms, are easy to find. Avoid using too much text that can confuse the buyer.

2. Use Branding

Add your company’s logo and use your business colors to give the invoice a professional look. This also helps with brand recognition.

3. Break Down Costs

Show each item’s price separately, along with the total. This helps avoid confusion about what the buyer is paying for.

4. Use Digital Invoices

Digital invoices are faster and easier to send. You can also integrate them with accounting software to keep better track of your business transactions.

5. Use Invoicing Software

If your business has a lot of transactions, consider using invoicing software. It will help you automate the invoicing process, saving time and ensuring accuracy.

Commercial Invoice Format for International Shipments

When you are shipping products internationally, your commercial invoice format needs to meet customs requirements. Customs officials use the invoice to determine how much tax and duties you must pay for the goods you’re shipping.

Additional details needed for international shipments include:

- HS Code: This is a code used to classify goods for customs purposes.

- Country of Origin: Indicate where the goods were manufactured.

- Export Declaration: Some countries require a declaration that the goods are being exported.

Common Mistakes to Avoid When Creating a Commercial Invoice Format

Here are some common mistakes businesses make when creating a commercial invoice and how to avoid them:

1. Missing Information

Ensure that all important details, such as the buyer’s address, product description, and total price, are included. Missing information can cause delays in payment or shipment.

2. Incorrect Pricing

Always double-check the prices and totals on your invoice. Pricing mistakes can lead to disputes and may delay payments.

3. Not Following Buyer’s Requirements

Some companies have specific invoicing requirements. If your buyer requests a specific format or details, make sure you follow their instructions to avoid delays.

4. Unclear Payment Terms

Always make sure the payment terms are clear. This includes when the payment is due and any penalties for late payment.

5. Lack of Customs Information

For international shipments, forgetting to include the customs-required details, like HS codes and country of origin, can delay your shipment at customs.

Conclusion

A commercial invoice format is an essential tool in business transactions. By including all the important details—such as buyer and seller information, a detailed list of products, payment terms, and total amounts—you ensure that the transaction is clear and smooth for both parties.

Whether you are conducting local or international business, following the steps above will help you create a professional invoice that protects your business and speeds up the payment process. Always double-check your invoice to avoid errors, and consider using digital tools to streamline the invoicing process.

Also Read

- What Documents Are Required for GST Registration in GST Billing Software?GST (Goods and Services Tax) registration is an essential step for businesses in India to comply with the tax regime and be eligible to collect tax on behalf of the government. If you’re a business owner, you likely need to… Read more: What Documents Are Required for GST Registration in GST Billing Software?

- Why Do Leading FMCG Products Distributorships Rely on Online FMCG Distribution Software Today?In India’s ever-evolving retail and wholesale landscape, FMCG Products Distributorships are the backbone of how essential goods reach millions of homes every day. From your local kirana store to large supermarket chains, it’s the distributors who ensure the steady supply… Read more: Why Do Leading FMCG Products Distributorships Rely on Online FMCG Distribution Software Today?

- What Details Must be Included in a Sale Bill with GST?Getting your GST paperwork wrong feels like walking through a minefield, doesn’t it? One missing detail on your invoices, and suddenly you’re dealing with compliance headaches that could’ve been easily avoided. Creating a proper Sale Bill with GST isn’t rocket… Read more: What Details Must be Included in a Sale Bill with GST?

- How Does a Billing Management System Help Reduce Human Errors?Running a business feels like juggling flaming torches sometimes, doesn’t it? One dropped ball can mean lost revenue, frustrated customers, or embarrassing mistakes. Manual billing processes are particularly tricky; they’re riddled with opportunities for human error that can cost your… Read more: How Does a Billing Management System Help Reduce Human Errors?

- What Role Does Accounting Software Play in Cost and Managerial Accounting?In today’s fast-paced business world, accuracy and speed are the names of the game. Whether you’re running a small business or managing a growing enterprise, tracking costs and making informed financial decisions are key. That’s where Accounting Software steps in,… Read more: What Role Does Accounting Software Play in Cost and Managerial Accounting?

Frequently Asked Question

What is a commercial invoice and why is it important?

A commercial invoice is a document that shows the details of a transaction between a buyer and a seller. It lists the products sold, the price, and payment terms. It’s important because it acts as proof of sale and is needed for customs when shipping internationally. It also helps both parties track the transaction.

What should be included in a commercial invoice format?

A commercial invoice format should include seller and buyer details, invoice number, date, a list of products or services, total cost, payment terms, and shipping details. For international shipments, customs information like HS codes and country of origin should be included as well.

How can I create a commercial invoice for my business?

To create a commercial invoice, you can use templates or invoicing software. Include details like buyer and seller information, product descriptions, unit prices, total cost, payment terms, and shipping information. For international shipments, add required customs details.

Do I need a special format for international invoices?

Yes, for international invoices, you must include customs details like the HS code, country of origin, and export declaration. These details help customs officials determine taxes and duties on your shipment, ensuring smooth cross-border trade.

What is the purpose of the invoice number on a commercial invoice?

The invoice number is a unique identifier that helps track each transaction. Both the buyer and seller use it to keep records and make sure payments are matched to the correct sale. It’s essential for organizing your invoices.

How do I include payment terms in a commercial invoice?

In the payment terms section, mention when the payment is due (e.g., Net 30 for 30 days). You can also include any discounts for early payments or penalties for late payments. This helps ensure you get paid on time and avoid confusion.

What is the difference between a commercial invoice and a packing list?

A commercial invoice lists the sale details, like products, prices, and payment terms, while a packing list describes the contents of the shipment, such as the quantity and type of items. Both documents may be used together, especially in international shipping.

Can I use digital tools to create commercial invoices?

Yes, using digital tools like invoicing software can make creating commercial invoices easier. These tools help you automate the process, save time, and reduce errors. They also allow for better tracking of your transactions and payments.

Why do I need to include shipping information on a commercial invoice?

Shipping information is needed on a commercial invoice to inform the buyer how and when the products will be delivered. It helps ensure that both parties know the shipping method, who is responsible for shipping costs, and the expected delivery time.

What happens if I make mistakes in my commercial invoice?

Mistakes in a commercial invoice can lead to delays in payment or shipping. For international shipments, missing customs information can cause delays at customs. Always double-check your invoice for accuracy to avoid such problems.