E-invoicing is revolutionizing how businesses manage their billing processes. The term “e-invoice” refers to an electronic invoice generated and exchanged between businesses in a structured digital format. Among various e-invoicing formats, the E-Invoice JSON format has gained significant popularity. JSON, which stands for JavaScript Object Notation, is a lightweight data interchange format that is easy to read and write for both humans and machines. This format is essential for businesses as it streamlines the invoicing process, reduces errors, and enhances efficiency. In this blog, we will discuss how to implement the E-Invoice JSON format in your business, providing detailed information on its benefits, implementation steps, and best practices.

Understanding the E-Invoice JSON Format

The E-Invoice JSON format is a standardized format designed to ensure consistency and interoperability across various systems. JSON is a text format that is completely language-independent but uses conventions familiar to programmers of the C-family of languages. It is primarily used to transmit data between a server and web application, serving as an alternative to XML. The key advantage of using JSON for e-invoicing is its simplicity and ease of integration.

Benefits of E-Invoice JSON Format

- Standardization: The E-Invoice JSON format adheres to a standardized structure, ensuring uniformity across different invoicing systems. This standardization helps businesses communicate more effectively and ensures that invoices are understood by all parties involved.

- Data Accuracy: By reducing manual data entry, the chances of errors are minimized, leading to more accurate invoicing. Accurate data ensures that there are fewer disputes and delays in payment, improving cash flow.

- Efficiency: Automation of the invoicing process speeds up the transaction cycle and improves overall efficiency. Efficient processes save time and resources, allowing businesses to focus on other important tasks.

- Cost Savings: Reduces the need for paper-based invoicing and manual processing, leading to significant cost savings. Cost savings can be reinvested in the business to drive growth and innovation.

- Compliance: Helps businesses comply with regulatory requirements by providing a standardized format for invoicing. Compliance with regulations avoids penalties and ensures smooth operations.

Steps to Implement E-Invoice JSON Format in Your Business

Implementing the E-Invoice JSON format in your business involves several steps, from understanding the format to integrating it into your existing systems. Here is a detailed guide to help you through the process.

1. Understand the JSON Schema

The first step in implementing the E-Invoice JSON format is to understand the JSON schema. The schema defines the structure of the JSON data, specifying the required fields, data types, and validation rules. Familiarize yourself with the schema provided by the relevant authorities or service providers. Understanding the schema ensures that your invoices are correctly formatted and comply with standards.

2. Choose the Right E-Invoicing Software

Selecting the appropriate e-invoicing software is crucial for a smooth transition to the E-Invoice JSON format. Ensure that the software supports JSON format and is compatible with your existing systems. Popular e-invoicing solutions like MargBooks offer comprehensive support for the E-Invoice JSON format, making it easier to integrate and manage your invoicing processes. The right software will simplify the implementation process and provide ongoing support.

3. Configure the JSON Settings

Once you have chosen the software, the next step is to configure the JSON settings. This involves setting up the parameters and fields as per the JSON schema. Ensure that all mandatory fields are correctly defined and that the data types match the schema requirements. Proper configuration is essential for the successful generation and exchange of e-invoices. Configuring the settings accurately ensures that the data is correctly formatted and understood by all systems.

4. Integrate with Your ERP System

Integration with your Enterprise Resource Planning (ERP) system is vital for seamless invoicing. Most businesses use ERP systems to manage their operations, and integrating e-invoicing with the ERP system ensures that invoicing data flows smoothly across various departments. Work with your IT team or software provider to establish this integration, ensuring that data synchronization is accurate and timely. A well-integrated system improves efficiency and reduces the risk of errors.

5. Test the Implementation

Before going live, it is crucial to test the implementation thoroughly. Generate sample e-invoices using the E-Invoice JSON format and validate them against the schema. Check for any errors or discrepancies and resolve them promptly. Testing helps identify and fix issues, ensuring that the implementation is smooth and error-free. Comprehensive testing avoids disruptions in your invoicing process and ensures a smooth transition.

6. Train Your Staff

Training your staff on the new e-invoicing system is essential for successful implementation. Conduct training sessions to familiarize your team with the E-Invoice JSON format, the invoicing software, and the new processes. Ensure that they understand how to generate, validate, and exchange e-invoices correctly. Well-trained staff are more efficient and less likely to make errors.

7. Monitor and Maintain

After implementing the E-Invoice JSON format, continuous monitoring and maintenance are necessary to ensure its effectiveness. Regularly check for updates to the JSON schema and software, and make necessary adjustments. Monitor the invoicing process to identify any issues or areas for improvement, ensuring that your e-invoicing system remains efficient and compliant. Ongoing maintenance ensures that your system remains up-to-date and continues to meet your business needs.

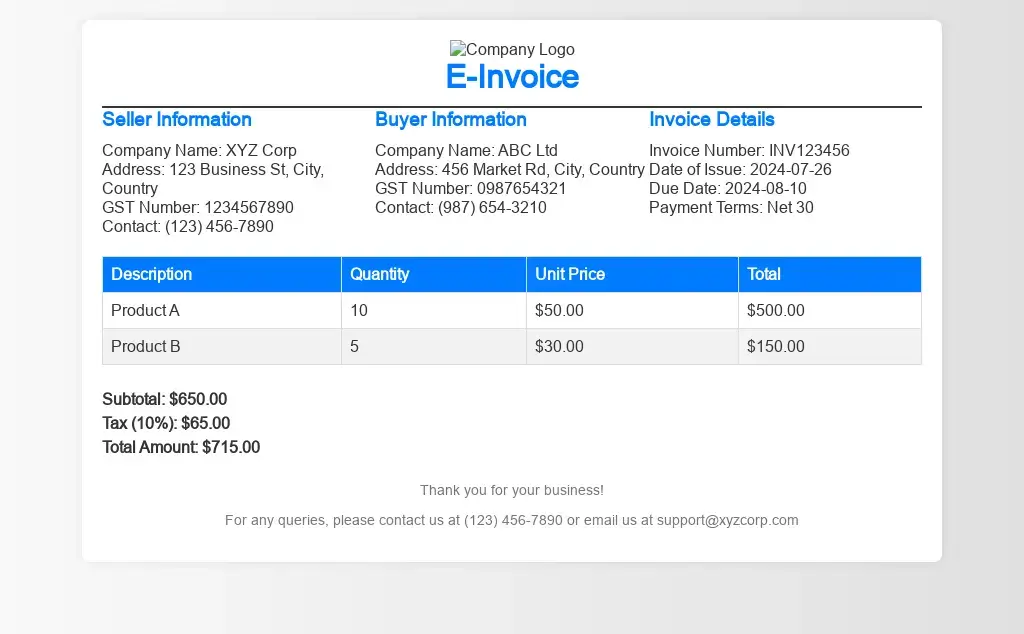

E Invoice JSON Format

Below is a detailed structure of a typical E-Invoice JSON format. This example includes key components such as the invoice header, seller and buyer details, invoice items, and tax information. The actual JSON structure might vary slightly based on regulatory requirements and the specific implementation guidelines in your country or industry.

{

"version": "1.1",

"invoice": {

"invoiceNumber": "INV-001",

"invoiceDate": "2023-07-

Certainly! Below is a detailed structure of a typical E-Invoice JSON format. This example includes key components such as the invoice header, seller and buyer details, invoice items, and tax information. The actual JSON structure might vary slightly based on regulatory requirements and the specific implementation guidelines in your country or industry.

{

"version": "1.1",

"invoice": {

"invoiceNumber": "INV-001",

"invoiceDate": "2023-07-26",

"supplyType": "B2B",

"documentType": "Tax Invoice",

"currency": "INR",

"seller": {

"sellerLegalName": "ABC Pvt Ltd",

"sellerGSTIN": "22AAAAA0000A1Z5",

"address": {

"street": "123, Business Street",

"city": "Mumbai",

"state": "Maharashtra",

"postalCode": "400001",

"country": "India"

},

"contact": {

"email": "info@abcpvtltd.com",

"phone": "022-12345678"

}

},

"buyer": {

"buyerLegalName": "XYZ Enterprises",

"buyerGSTIN": "27BBBBB1111B2Z6",

"address": {

"street": "456, Corporate Avenue",

"city": "Pune",

"state": "Maharashtra",

"postalCode": "411001",

"country": "India"

},

"contact": {

"email": "purchase@xyzenterprises.com",

"phone": "020-87654321"

}

},

"invoiceItems": [

{

"itemDescription": "Product A",

"quantity": 10,

"unitPrice": 100,

"totalPrice": 1000,

"hsnCode": "1234",

"gstRate": 18,

"taxAmount": {

"cgstAmount": 90,

"sgstAmount": 90,

"igstAmount": 0,

"totalTaxAmount": 180

}

},

{

"itemDescription": "Product B",

"quantity": 5,

"unitPrice": 200,

"totalPrice": 1000,

"hsnCode": "5678",

"gstRate": 18,

"taxAmount": {

"cgstAmount": 90,

"sgstAmount": 90,

"igstAmount": 0,

"totalTaxAmount": 180

}

}

],

"totalAmount": 2000,

"totalTaxAmount": 360,

"grandTotal": 2360,

"paymentDetails": {

"paymentTerms": "Net 30",

"paymentMode": "Bank Transfer",

"bankDetails": {

"accountNumber": "1234567890",

"bankName": "State Bank of India",

"branch": "Mumbai",

"ifscCode": "SBIN0001234"

}

},

"additionalInformation": {

"comments": "Thank you for your business.",

"termsAndConditions": "Payment due within 30 days."

}

}

}

Explanation of Each Section:

Header Information

- version: The version of the e-invoice format.

- invoiceNumber: A unique identifier for the invoice.

- invoiceDate: The date the invoice was issued.

- supplyType: The type of supply, e.g., B2B (business to business), B2C (business to consumer).

- documentType: The type of document, e.g., Tax Invoice, Credit Note.

- currency: The currency in which the invoice is issued.

Seller and Buyer Information

- seller: Details about the seller, including legal name, GSTIN (Goods and Services Tax Identification Number), address, and contact information.

- buyer: Details about the buyer, including legal name, GSTIN, address, and contact information.

Invoice Items

- invoiceItems: A list of items being invoiced. Each item includes:

- itemDescription: A description of the item.

- quantity: The quantity of the item.

- unitPrice: The price per unit.

- totalPrice: The total price for the item (quantity x unit price).

- hsnCode: The Harmonized System Nomenclature code for the item.

- gstRate: The GST rate applicable to the item.

- taxAmount: The amount of GST, broken down into CGST (Central GST), SGST (State GST), and IGST (Integrated GST).

Totals

- totalAmount: The total amount before tax.

- totalTaxAmount: The total tax amount.

- grandTotal: The total amount after including tax.

Payment Details

- paymentDetails: Information about the payment terms and mode of payment.

- paymentTerms: The terms of payment, e.g., Net 30 (payment due in 30 days).

- paymentMode: The mode of payment, e.g., Bank Transfer.

- bankDetails: Details of the bank account for payment, including account number, bank name, branch, and IFSC code.

Additional Information

- additionalInformation: Any additional comments or terms and conditions.

Best Practices for Implementing E-Invoice JSON Format

To ensure a successful implementation of the E-Invoice JSON format, follow these best practices:

Standardize Your Data

Standardizing your data ensures consistency and accuracy in your e-invoices. Use standardized naming conventions and data formats across all your invoicing processes. Consistent data makes it easier to manage and reduces the risk of errors.

Automate Where Possible

Automate as many aspects of the invoicing process as possible. Automation reduces the chances of human error and speeds up the process, making it more efficient. Automated processes free up time for your staff to focus on more valuable tasks.

Keep Up with Regulatory Changes

Stay informed about any regulatory changes related to e-invoicing and the E-Invoice JSON format. Regularly update your systems and processes to comply with new regulations. Staying compliant avoids penalties and ensures smooth operations.

Ensure Data Security

Data security is paramount when handling electronic invoices. Implement robust security measures to protect your invoicing data from unauthorized access and breaches. Secure data ensures that your business and customers are protected.

Seek Expert Assistance

If you encounter any challenges during the implementation process, do not hesitate to seek expert assistance. Consult with your software provider or hire a consultant with experience in e-invoicing to guide you through the process. Expert advice can save time and ensure a successful implementation.

Common Challenges and Solutions

Data Mapping Issues

One of the common challenges businesses face when implementing the E-Invoice JSON format is data mapping. Mapping your existing data fields to the JSON schema can be complex. To overcome this, work closely with your IT team or software provider to ensure accurate data mapping. Accurate mapping ensures that your invoices are correctly formatted and understood by all parties.

Integration Difficulties

Integrating the E-Invoice JSON format with your ERP system can be challenging. Ensure that your ERP system supports JSON integration and seek assistance from your software provider to establish a seamless integration. Proper integration improves efficiency and reduces the risk of errors.

Resistance to Change

Employees may resist the change to a new invoicing system. To address this, provide comprehensive training and highlight the benefits of the new system. Encourage feedback and involve your team in the implementation process to gain their support. Engaging your staff ensures a smoother transition and improves the adoption of the new system.

Conclusion

Implementing the E-Invoice JSON format in your business can significantly enhance your invoicing process, improving efficiency, accuracy, and compliance. By following the steps outlined in this guide and adhering to best practices, you can successfully transition to the E-Invoice JSON format. Stay informed about regulatory changes, ensure data security, and continuously monitor and maintain your e-invoicing system to reap the full benefits of this innovative solution.

Remember, a well-implemented e-invoicing system can transform your business operations, making them more efficient and cost-effective. If you need further details or assistance on implementing the E-Invoice JSON format, feel free to reach out. A successful implementation not only improves your invoicing process but also enhances overall business operations. With the right approach and tools, you can make the transition smoothly and enjoy the numerous benefits that the E-Invoice JSON format offers.

Also Read

- How to Ensure Data Security in Your Invoice Management SystemIn today’s digital age, businesses rely heavily on technology to streamline operations and improve efficiency. An invoice management system plays a crucial role in managing financial transactions and maintaining accurate records. However, with the increasing reliance on technology comes the… Read more: How to Ensure Data Security in Your Invoice Management System

- GST Invoice Software: Making Billing EasyIn today’s busy world of business, being efficient is super important. One big thing that needs to be super efficient is billing. With new technology, old-fashioned manual billing is out of date and can make a lot of mistakes. That’s… Read more: GST Invoice Software: Making Billing Easy

- GST Invoice Format for HotelIn the hospitality industry, especially for hotels, managing financial transactions is a very important task. One key part of this financial management is creating invoices that follow the rules of the Goods and Services Tax (GST) in India. Having a… Read more: GST Invoice Format for Hotel

- GST Composition Invoice FormatThe GST (Goods and Services Tax) Composition Scheme is a straightforward and user-friendly taxation scheme designed for small businesses in India. This scheme reduces the compliance burden for small taxpayers by allowing them to pay GST at a fixed rate… Read more: GST Composition Invoice Format

- Everything You Should Know About Car Bill InvoiceWhen it comes to car purchases, sales, repairs, or rentals, a car bill invoice is an essential document. This invoice serves as a record of the transaction and provides a detailed account of the services rendered or goods sold. Understanding… Read more: Everything You Should Know About Car Bill Invoice

Frequently Asked Questions

What is an E-Invoice JSON format?

An E-Invoice JSON format is a standardized way of structuring electronic invoices using JSON (JavaScript Object Notation). It allows businesses to generate, exchange, and manage invoices in a consistent, digital format that is easy for both humans and machines to understand. This format reduces errors, improves data accuracy, and makes the invoicing process more efficient.

Why should I use E-Invoice JSON format for my business?

Using the E-Invoice JSON format offers several benefits, including improved accuracy, faster processing, and reduced manual work. It standardizes the invoicing process, making it easier to integrate with other systems like ERP. This leads to cost savings, better compliance with regulations, and a more efficient invoicing workflow.

How do I choose the right software for E-Invoice JSON format?

To choose the right software for E-Invoice JSON format, look for features such as JSON support, compatibility with your existing systems, and user-friendly interfaces. Check if the software integrates well with your ERP system and if it offers good customer support. Popular options like MargBooks can simplify the implementation and management of e-invoices.

What steps are involved in implementing E-Invoice JSON format?

Implementing E-Invoice JSON format involves several key steps: understanding the JSON schema, selecting appropriate software, configuring JSON settings, integrating with your ERP system, testing the implementation, training your staff, and ongoing monitoring and maintenance. Each step ensures a smooth transition and effective use of the E-Invoice JSON format.

How do I configure JSON settings for E-Invoice?

Configuring JSON settings involves setting up parameters and fields according to the JSON schema. This includes defining mandatory fields, ensuring correct data types, and validating the configuration. Proper configuration is crucial to generate and exchange e-invoices accurately and to ensure they comply with the required standards.

What are common challenges when using E-Invoice JSON format?

Common challenges include data mapping issues, integration difficulties, and resistance to change. Data mapping involves aligning your existing data with the JSON schema, while integration may require technical adjustments. Overcoming resistance involves training staff and demonstrating the benefits of the new system. Addressing these challenges effectively ensures a smooth implementation.

How can I ensure data accuracy with E-Invoice JSON format?

To ensure data accuracy with E-Invoice JSON format, use automated tools to minimize manual entry errors, configure your JSON settings correctly, and conduct thorough testing. Regularly update and maintain your systems to comply with any changes in regulations or standards. Accurate data leads to fewer disputes and delays in payment.

How do I train my staff for the E-Invoice JSON system?

Training your staff involves organizing sessions to explain the E-Invoice JSON format, how to use the new software, and the updated invoicing processes. Provide practical examples and hands-on practice to help them understand and adapt to the new system. Continuous support and feedback can further enhance their proficiency.

What should I monitor after implementing E-Invoice JSON format?

After implementing the E-Invoice JSON format, monitor for issues such as data errors, integration problems, and system performance. Regularly check for updates to the JSON schema and software, and ensure ongoing compliance with regulations. Continuous monitoring helps maintain the effectiveness and efficiency of your e-invoicing system.

How does E-Invoice JSON format help with regulatory compliance?

E-Invoice JSON format helps with regulatory compliance by providing a standardized structure for invoices, which meets legal and industry requirements. It ensures that invoices are formatted correctly and contain all necessary information, reducing the risk of non-compliance. Staying updated with any changes in regulations and maintaining accurate records further supports compliance efforts.