Creating an effective and professional travel agency invoice format is crucial for any travel business. It ensures that transactions are recorded accurately, helps in tracking payments, and provides clear information to clients. An invoice that is well-structured not only reflects the professionalism of your travel agency but also aids in maintaining financial records systematically. This comprehensive guide will help you understand the key components and steps involved in making a travel agency invoice format.

Understanding the Importance of a Travel Agency Invoice

Invoices are essential documents in any business. For a travel agency, an invoice serves multiple purposes:

- Record Keeping: Invoices act as a record of services provided and payments received. This helps in maintaining accurate financial records, which is crucial for tracking the performance of your business and ensuring everything is accounted for.

- Client Communication: They provide clients with a detailed breakdown of the services they are being charged for, enhancing transparency. This transparency builds trust and helps clients understand exactly what they are paying for, which can improve their overall satisfaction with your services.

- Payment Tracking: Invoices help in tracking payments and outstanding balances, making it easier to manage cash flow. By knowing which payments have been made and which are still pending, you can better manage your agency’s finances and ensure timely follow-ups on overdue payments.

- Legal Documentation: They serve as legal documents that can be referred to in case of disputes regarding payments. Having clear and detailed invoices can protect your business in case of disagreements or legal issues.

Key Components of a Travel Agency Invoice Format

A travel agency invoice should include specific elements to ensure it is comprehensive and easy to understand. Here are the key components:

1. Header

The header of your invoice should contain your travel agency’s name, logo, and contact information. This makes it easy for the client to identify who the invoice is from and how to contact you if needed. Including your logo also helps reinforce your brand identity.

2. Invoice Number

Assign a unique invoice number to each invoice. This helps in organizing and tracking invoices efficiently. You can use a sequential numbering system for simplicity. A unique invoice number also helps in referencing specific invoices quickly.

3. Date of Issue

Include the date when the invoice is issued. This is important for record-keeping and for clients to know when the invoice was created. It helps in tracking the timeline of the transaction.

4. Client Information

Clearly mention the client’s name and contact details. This ensures that the invoice is personalized and reaches the correct recipient. Accurate client information is crucial for clear communication and avoiding any confusion.

5. Description of Services

Provide a detailed description of the services provided. This could include:

- Flight bookings

- Hotel reservations

- Car rentals

- Tour packages

- Travel insurance

Make sure to break down each service separately to avoid confusion. A clear description helps the client understand what they are being billed for and ensures there are no misunderstandings.

6. Cost Breakdown

For each service listed, provide a cost breakdown. This should include:

- Service description

- Quantity (if applicable)

- Unit price

- Total cost

A detailed cost breakdown helps in understanding the charges for each service and ensures transparency.

7. Subtotal

Calculate and mention the subtotal of all services before taxes and discounts. The subtotal provides a clear picture of the total cost of services before any additional charges are applied.

8. Taxes

Include any applicable taxes. Specify the tax rate and the total tax amount. This ensures that the client is aware of the tax charges and understands the total cost.

9. Discounts

If there are any discounts offered, mention them clearly. Subtract the discount amount from the subtotal. Clear mention of discounts ensures that the client understands the benefits they are receiving.

10. Total Amount Due

Clearly state the total amount due after adding taxes and subtracting discounts. This is the amount the client needs to pay. A clear total amount due helps in avoiding any confusion regarding the final payment.

11. Payment Terms

Specify the payment terms, such as the due date and accepted payment methods (e.g., bank transfer, credit card, PayPal). This sets clear expectations for the client regarding payment. Clear payment terms help in ensuring timely payments and avoid misunderstandings.

12. Additional Notes

Include any additional notes or instructions for the client. This could be information about your cancellation policy, a thank you note, or any other relevant information. Additional notes help in providing any extra information that might be important for the client.

Steps to Create a Travel Agency Invoice Format

Creating a travel agency invoice format involves several steps. Here’s a step-by-step guide:

Step 1: Choose an Invoice Template

Start by choosing an invoice template that suits your travel agency’s branding. You can find various templates online or use invoicing software that offers customizable templates. Ensure the template is professional and includes all the key components mentioned above. A well-designed template helps in creating a good impression and ensures consistency.

Step 2: Add Your Agency’s Details

Enter your travel agency’s name, logo, and contact information in the header of the invoice. This establishes your brand identity and makes it easy for clients to reach you. Including your contact details ensures that clients can easily get in touch if they have any questions.

Step 3: Insert Invoice Number and Date

Assign a unique invoice number and enter the date of issue. Ensure that the invoice number follows a sequential order for easy tracking. A unique invoice number helps in referencing the invoice and tracking payments.

Step 4: Enter Client Information

Add the client’s name and contact details. Double-check the information to avoid any errors. Accurate client information ensures that the invoice reaches the correct person.

Step 5: List Services Provided

Provide a detailed list of services provided to the client. Be specific and clear in your descriptions to avoid any misunderstandings. A detailed list of services helps the client understand what they are being charged for.

Step 6: Provide Cost Breakdown

For each service listed, provide a cost breakdown. This includes the unit price, quantity (if applicable), and total cost. Ensure the calculations are accurate. A detailed cost breakdown ensures transparency and helps in avoiding disputes.

Step 7: Calculate Subtotal

Sum up the total cost of all services to get the subtotal. Enter this amount in the appropriate field. The subtotal provides a clear picture of the total cost before any additional charges.

Step 8: Add Taxes and Discounts

Calculate the applicable taxes and add them to the subtotal. If any discounts are offered, subtract them from the subtotal. Ensure that the tax and discount calculations are correct. Clear mention of taxes and discounts helps in understanding the final amount due.

Step 9: Enter Total Amount Due

Calculate the total amount due after adding taxes and subtracting discounts. Enter this amount clearly in the total amount due field. A clear total amount due helps in avoiding any confusion regarding the payment.

Step 10: Specify Payment Terms

Clearly specify the payment terms, including the due date and accepted payment methods. This helps in setting clear expectations for the client. Clear payment terms ensure timely payments and avoid misunderstandings.

Step 11: Add Additional Notes

Include any additional notes or instructions for the client. This could be a thank you note, information about your cancellation policy, or any other relevant details. Additional notes help in providing any extra information that might be important for the client.

Step 12: Review and Send

Before sending the invoice, review it thoroughly to ensure all information is accurate and complete. Once verified, send the invoice to the client via email or any other preferred method. Reviewing the invoice ensures accuracy and professionalism.

Tips for Creating an Effective Travel Agency Invoice Format

Creating a travel agency invoice format involves more than just filling in details. Here are some tips to ensure your invoices are effective and professional:

1. Keep It Simple and Clear

Avoid cluttering your invoice with unnecessary information. Keep it simple and clear to ensure the client can easily understand the details. Simplicity and clarity help in avoiding confusion and ensure the client understands the invoice.

2. Use Professional Language

Maintain a professional tone throughout the invoice. Use clear and concise language to convey information effectively. Professional language reflects your agency’s professionalism and helps in building trust.

3. Be Detailed

Provide detailed descriptions of the services provided. This helps in avoiding any misunderstandings and ensures the client knows exactly what they are being charged for. Detailed descriptions enhance transparency and clarity.

4. Ensure Accuracy

Double-check all information, including cost calculations, tax rates, and client details. Accuracy is crucial to maintain professionalism and avoid disputes. Accurate information helps in building trust and avoiding misunderstandings.

5. Use Consistent Formatting

Maintain consistent formatting throughout the invoice. Use the same font, font size, and color scheme to ensure a professional look. Consistent formatting enhances the overall appearance and readability of the invoice.

6. Include Your Branding

Incorporate your travel agency’s branding in the invoice. This includes your logo, brand colors, and any other elements that represent your brand. Branding helps in reinforcing your agency’s identity and ensures a professional look.

7. Send Promptly

Send the invoice promptly after providing the services. This ensures timely payment and reflects your agency’s professionalism. Prompt invoicing helps in managing cash flow and ensures timely payments.

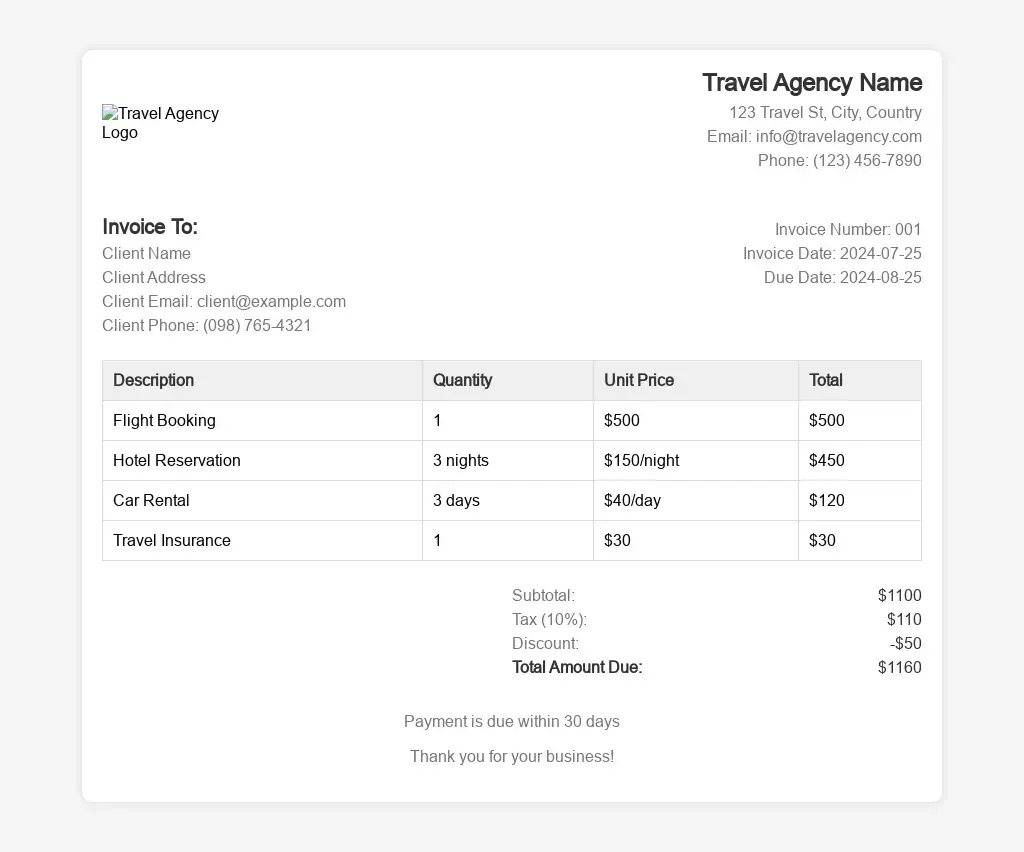

Travel Agency Invoice Format Example

Travel Agency Invoice

Travel Agency Invoice

Travel Agency Name

1234 Travel Street, City, State, 56789

Email: contact@travelagency.com | Phone: (123) 456-7890

| Invoice Number | #001234 |

|---|---|

| Date of Issue | July 25, 2024 |

| Client Name | John Doe |

|---|---|

| Contact Information | john.doe@example.com | (123) 987-6543 |

| Service | Quantity | Unit Price | Total |

|---|---|---|---|

| Flight Booking | 2 | $500 | $1000 |

| Hotel Reservation | 5 nights | $150 | $750 |

| Car Rental | 3 days | $70 | $210 |

| Tour Package | 1 | $300 | $300 |

Please make the payment by August 10, 2024. Accepted payment methods: Bank Transfer, Credit Card, PayPal.

Thank you for choosing our travel agency. If you have any questions regarding this invoice, please contact us at contact@travelagency.com or (123) 456-7890.

Benefits of Using Invoicing Software

Using invoicing software can streamline the process of creating and managing invoices. Here are some benefits:

1. Automation

Invoicing software automates the process of creating and sending invoices. This saves time and reduces the chances of errors. Automation helps in ensuring accuracy and efficiency.

2. Customization

Most invoicing software offers customizable templates. This allows you to create invoices that align with your branding and meet your specific needs. Customization helps in creating a professional and personalized invoice.

3. Payment Tracking

Invoicing software often includes features for tracking payments and sending reminders for overdue invoices. This helps in managing cash flow effectively. Payment tracking ensures timely follow-ups and avoids delays.

4. Reporting

Many invoicing software options provide reporting features. This allows you to generate reports on invoicing and payment history, helping in financial analysis and decision-making. Reporting features provide valuable insights into your business performance.

5. Integration

Invoicing software can often integrate with other business tools such as accounting software, CRM systems, and payment gateways. This streamlines your business processes and enhances efficiency. Integration helps in managing all aspects of your business seamlessly.

Conclusion

Creating a travel agency invoice format is an important aspect of running a travel business. By following the steps and tips mentioned in this guide, you can create professional and effective invoices that enhance your business operations and client relationships. Consider using invoicing software to further streamline the process and ensure accuracy and efficiency.

Also Read

- How to Ensure Data Security in Your Invoice Management SystemIn today’s digital age, businesses rely heavily on technology to streamline operations and improve efficiency. An invoice management system plays a crucial role in managing financial transactions and maintaining accurate records. However, with the increasing reliance on technology comes the… Read more: How to Ensure Data Security in Your Invoice Management System

- GST Invoice Software: Making Billing EasyIn today’s busy world of business, being efficient is super important. One big thing that needs to be super efficient is billing. With new technology, old-fashioned manual billing is out of date and can make a lot of mistakes. That’s… Read more: GST Invoice Software: Making Billing Easy

- GST Invoice Format for HotelIn the hospitality industry, especially for hotels, managing financial transactions is a very important task. One key part of this financial management is creating invoices that follow the rules of the Goods and Services Tax (GST) in India. Having a… Read more: GST Invoice Format for Hotel

- GST Composition Invoice FormatThe GST (Goods and Services Tax) Composition Scheme is a straightforward and user-friendly taxation scheme designed for small businesses in India. This scheme reduces the compliance burden for small taxpayers by allowing them to pay GST at a fixed rate… Read more: GST Composition Invoice Format

- Everything You Should Know About Car Bill InvoiceWhen it comes to car purchases, sales, repairs, or rentals, a car bill invoice is an essential document. This invoice serves as a record of the transaction and provides a detailed account of the services rendered or goods sold. Understanding… Read more: Everything You Should Know About Car Bill Invoice

Frequently Asked Questions

What details should a travel agency invoice include?

A travel agency invoice should include your agency’s name, logo, and contact information, along with the invoice number, date of issue, and client details. List the services provided with a clear description and cost breakdown. Include the subtotal, applicable taxes, discounts, and the total amount due. Also, specify payment terms, such as due date and payment methods, and add any additional notes or instructions for the client. This ensures transparency, accurate record-keeping, and helps in managing payments efficiently.

How can I ensure my travel agency invoices are professional?

To ensure your invoices look professional, use a clean and simple template with your agency’s logo and branding. Maintain consistent formatting and use clear, concise language. Provide detailed descriptions of services and a precise cost breakdown. Double-check for accuracy in all details, including client information and cost calculations. Sending invoices promptly after providing services also reflects professionalism. Using invoicing software can further enhance the professional appearance and management of your invoices.

Why is a unique invoice number important?

A unique invoice number is crucial for organizing and tracking invoices. It helps you and your clients easily reference specific invoices, avoiding confusion. Using a sequential numbering system ensures each invoice is distinct and can be easily located in your records. This is particularly important for resolving disputes, tracking payments, and maintaining accurate financial records. A unique invoice number streamlines your billing process and enhances your overall invoicing efficiency.

How can invoicing software benefit my travel agency?

Invoicing software can greatly benefit your travel agency by automating the creation and sending of invoices, reducing errors, and saving time. It offers customizable templates that align with your branding. The software tracks payments, sends reminders for overdue invoices, and integrates with other business tools like accounting software and payment gateways. Additionally, it provides reporting features to analyze your financial data, helping you make informed decisions and manage your business more effectively.

What should be included in the service description on the invoice?

The service description should provide a clear and detailed breakdown of each service provided, such as flight bookings, hotel reservations, car rentals, tour packages, and travel insurance. Include specific details like dates, destinations, and any special requests or packages chosen by the client. A comprehensive description ensures the client understands exactly what they are being charged for, reduces the risk of disputes, and enhances transparency and trust in your services.

How do I calculate the total amount due on an invoice?

To calculate the total amount due, start by adding the cost of all services provided to get the subtotal. Then, calculate any applicable taxes and add this to the subtotal. If there are any discounts, subtract these from the subtotal. The resulting amount is the total amount due. Clearly state this amount on the invoice to ensure the client knows exactly how much they need to pay. This clarity helps in avoiding payment delays and misunderstandings.

What are the best practices for listing taxes on an invoice?

When listing taxes on an invoice, specify the tax rate and the total tax amount separately. Clearly indicate the tax type (e.g., VAT, sales tax) to avoid confusion. Ensure that the tax calculations are accurate and compliant with local regulations. Including taxes in a separate line item helps clients understand the tax component of their bill and ensures transparency. Keeping tax details clear and accurate also helps in maintaining compliant financial records.

How can I make payment terms clear on my invoices?

To make payment terms clear, explicitly state the due date for the payment and the accepted payment methods (e.g., bank transfer, credit card, PayPal). You can also include any late payment fees or discounts for early payments. Use clear and simple language to ensure the client understands when and how to make the payment. Providing clear payment terms helps in setting client expectations and ensuring timely payments, which is crucial for managing cash flow.

What should I include in the additional notes section?

In the additional notes section, include any relevant information that doesn’t fit into the main invoice components. This could be a thank you note, your cancellation policy, special instructions, or additional terms and conditions. You can also use this space to inform clients about upcoming promotions or new services. Including these notes enhances communication and provides important information that might be useful to the client, adding a personal touch to your invoice.

How can I avoid errors in my travel agency invoices?

To avoid errors, double-check all information before sending the invoice. Ensure client details, service descriptions, cost breakdowns, and calculations are accurate. Use a consistent invoice template to maintain uniformity. Reviewing the invoice for typos and inaccuracies is crucial. Using invoicing software can further minimize errors by automating calculations and data entry. Accurate invoicing prevents disputes, builds client trust, and ensures smooth financial transactions for your travel agency.