Creating a purchase invoice format is an essential task for any business, whether big or small. A purchase invoice is a document that records the details of a transaction between a buyer and a seller. It is a critical component of financial record-keeping, helping businesses track their expenses and manage their cash flow. This blog will guide you through the steps of creating an effective purchase invoice format, ensuring it is both professional and comprehensive.

What is a Purchase Invoice?

A purchase invoice is a document issued by a seller to a buyer. It details the goods or services purchased, the quantity, the price, and the total amount due. It serves as a formal request for payment and provides a record for both parties. A well-designed purchase invoice format helps maintain transparency and ensures that all necessary information is included. It acts as a formal request for payment and ensures both parties have a record of the transaction.

Importance of a Purchase Invoice

Financial Record-Keeping

A purchase invoice is crucial for maintaining accurate financial records. It helps businesses keep track of their expenses, monitor cash flow, and prepare for audits. Proper record-keeping is essential for financial planning and budgeting. By keeping accurate records, you can track your spending, make informed financial decisions, and prepare for audits. This helps in budgeting and financial planning, making sure your business stays on track.

Legal Proof of Transaction

A purchase invoice serves as legal proof of a transaction. It can be used to resolve disputes and verify the terms of the sale. Having a well-documented invoice helps protect both the buyer and the seller in case of any disagreements. This means if there is ever a disagreement about the transaction, the invoice can be used to clear things up and confirm what was agreed upon.

Tax Compliance

Invoices are necessary for tax purposes. They provide the documentation required to claim input tax credits and ensure compliance with tax regulations. A clear and accurate purchase invoice format simplifies the tax filing process and reduces the risk of errors. This makes the tax filing process easier and helps avoid mistakes that could lead to fines or penalties.

Essential Components of a Purchase Invoice

Creating an effective purchase invoice format involves including several key components. Each component plays a crucial role in ensuring the invoice is complete and professional. Below are the essential parts you should include:

Header

The header section of a purchase invoice typically includes the following elements:

- Business Name and Logo: Display your business name and logo prominently at the top of the invoice. This helps with brand recognition and gives the invoice a professional look.

- Contact Information: Include your business address, phone number, and email address. This information makes it easy for the buyer to contact you if they have any questions or concerns.

- Invoice Number: Assign a unique invoice number to each invoice. This helps with tracking and organizing your invoices.

- Invoice Date: Include the date the invoice was issued. This is important for record-keeping and payment tracking.

Buyer Information

Provide the buyer’s details, including:

- Buyer’s Name: Include the name of the individual or business purchasing the goods or services.

- Buyer’s Address: Add the buyer’s billing address for reference.

- Contact Information: Include the buyer’s phone number and email address for communication purposes.

Description of Goods or Services

Clearly describe the goods or services provided. This section should include:

- Item Description: Provide a detailed description of each item or service.

- Quantity: Specify the quantity of each item purchased.

- Unit Price: Include the price per unit of each item or service.

- Total Price: Calculate the total price for each item (quantity multiplied by unit price).

Payment Terms

Outline the payment terms clearly. This section should cover:

- Total Amount Due: Specify the total amount the buyer needs to pay.

- Payment Due Date: Indicate the due date for the payment. This helps avoid late payments and clarifies the payment timeline.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfer, credit card, or online payment platforms.

Additional Information

You can include additional information that may be relevant to the transaction. This could include:

- Tax Information: Include any applicable taxes and their rates.

- Discounts or Special Offers: If there are any discounts or special offers, mention them clearly.

- Terms and Conditions: Include any terms and conditions related to the sale or payment.

Designing a Professional Purchase Invoice Format

A well-designed purchase invoice format not only looks professional but also ensures all necessary information is included. Here are some tips for designing an effective invoice format:

Use a Template

Using a template can save time and ensure consistency. There are many invoice templates available online that you can customize to fit your business needs. Look for templates that include all the essential components mentioned above.

Keep It Simple and Clean

A clean and simple design makes it easy for the buyer to read and understand the invoice. Avoid clutter and use a clear, legible font. Ensure there is enough white space to separate different sections of the invoice.

Organize Information Logically

Organize the information logically, starting with the header, followed by the buyer’s information, description of goods or services, payment terms, and additional information. This logical flow helps the buyer quickly find the information they need.

Use Professional Language

Use professional language throughout the invoice. Avoid slang or informal language. Ensure that the tone of the invoice matches the professionalism of your business.

Highlight Important Information

Use bold or different colors to highlight important information, such as the total amount due and the payment due date. This helps ensure that critical details are not overlooked.

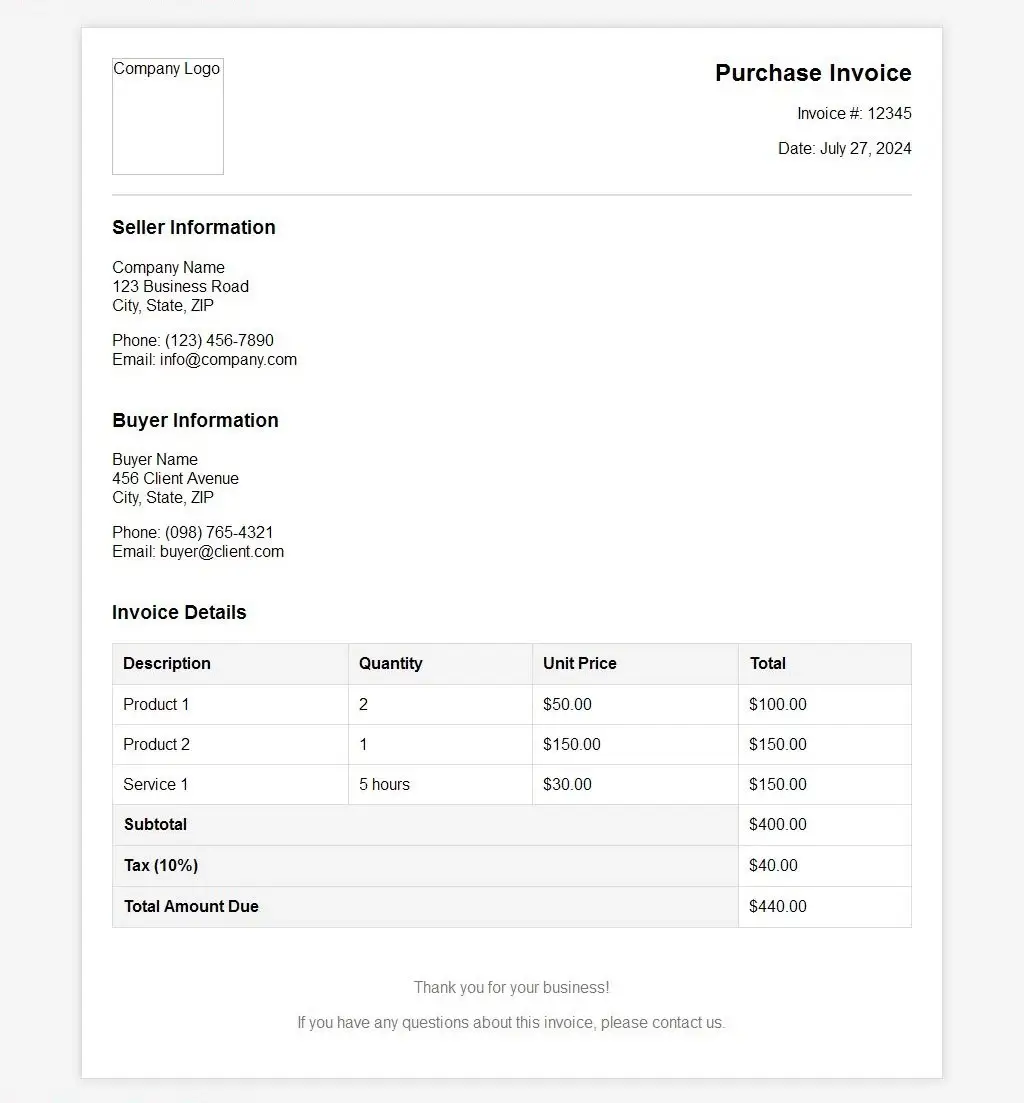

Purchase Invoice Format Example

|

|||

|

|||

| Payment Method | Check # | ||

| Check | 1000 | ||

| Item | Price | ||

| Website design | $300.00 | ||

| Hosting (3 months) | $75.00 | ||

| Domain name (1 year) | $10.00 | ||

| Total: $385.00 | |||

Steps to Create a Purchase Invoice Format

Creating a purchase invoice format involves several steps. Here’s a step-by-step guide to help you create a comprehensive and professional invoice format:

Step 1: Choose a Template

Select a template that fits your business needs. You can find free templates online or use software like Microsoft Word, Excel, or specialized invoicing software.

Step 2: Add Your Business Details

Enter your business name, logo, and contact information at the top of the invoice. Ensure that this information is clear and easy to read.

Step 3: Include Buyer Information

Add the buyer’s details, including their name, address, and contact information. Double-check this information for accuracy.

Step 4: List Goods or Services

Provide a detailed description of the goods or services provided. Include the quantity, unit price, and total price for each item. Ensure that the descriptions are clear and accurate.

Step 5: Specify Payment Terms

Outline the payment terms, including the total amount due, payment due date, and accepted payment methods. Make this information prominent on the invoice.

Step 6: Add Additional Information

Include any additional information, such as tax details, discounts, and terms and conditions. Ensure this information is relevant and clearly stated.

Step 7: Review and Finalize

Review the invoice for any errors or omissions. Ensure that all the information is accurate and complete. Once you are satisfied, save the invoice as a template for future use.

Using Software to Create Purchase Invoices

Using invoicing software can streamline the process of creating purchase invoices. There are many invoicing software options available, each with its own features and benefits. Here are some advantages of using invoicing software:

Automation

Invoicing software can automate many aspects of the invoicing process, such as calculating totals, applying taxes, and generating invoice numbers. This reduces the risk of errors and saves time.

Customization

Most invoicing software allows you to customize your invoice templates to match your brand. You can add your logo, choose your colors, and customize the layout to suit your preferences.

Record-Keeping

Invoicing software helps you keep track of all your invoices in one place. You can easily search for past invoices, track payments, and generate reports.

Integration

Many invoicing software options integrate with other business tools, such as accounting software, payment gateways, and customer relationship management (CRM) systems. This integration simplifies your workflow and ensures that all your systems work together seamlessly.

Best Practices for Creating a Purchase Invoice Format

Following best practices ensures that your purchase invoices are effective and professional. Here are some tips to keep in mind:

Ensure Accuracy

Double-check all the information on your invoice for accuracy. This includes the buyer’s details, item descriptions, quantities, prices, and totals. Accurate invoices help avoid disputes and ensure timely payments.

Be Clear and Concise

Ensure that the information on your invoice is clear and concise. Avoid unnecessary jargon and ensure that all the details are easy to understand.

Follow Up on Payments

Keep track of your invoices and follow up on any overdue payments. Send reminders to buyers who have not paid by the due date. Timely follow-ups help maintain cash flow and ensure that you get paid on time.

Keep Records

Maintain copies of all your invoices for your records. This is important for financial record-keeping, tax compliance, and resolving any disputes that may arise.

Use Digital Invoices

Consider using digital invoices instead of paper invoices. Digital invoices are easier to send, track, and store. They are also more environmentally friendly.

Conclusion

Creating a purchase invoice format is an essential task for any business. A well-designed invoice ensures that all necessary information is included and helps maintain accurate financial records. By following the steps outlined in this blog, you can create a comprehensive and professional purchase invoice format that meets your business needs. Remember to use templates, organize information logically, and ensure accuracy to create effective purchase invoices. Using invoicing software can further streamline the process and provide additional benefits, such as automation and integration with other business tools. Follow best practices to maintain professionalism and efficiency in your invoicing process, ensuring that your business runs smoothly and effectively.

Also Read

- How to Ensure Data Security in Your Invoice Management SystemIn today’s digital age, businesses rely heavily on technology to streamline operations and improve efficiency. An invoice management system plays a crucial role in managing financial transactions and maintaining accurate records. However, with the increasing reliance on technology comes the… Read more: How to Ensure Data Security in Your Invoice Management System

- GST Invoice Software: Making Billing EasyIn today’s busy world of business, being efficient is super important. One big thing that needs to be super efficient is billing. With new technology, old-fashioned manual billing is out of date and can make a lot of mistakes. That’s… Read more: GST Invoice Software: Making Billing Easy

- GST Invoice Format for HotelIn the hospitality industry, especially for hotels, managing financial transactions is a very important task. One key part of this financial management is creating invoices that follow the rules of the Goods and Services Tax (GST) in India. Having a… Read more: GST Invoice Format for Hotel

- GST Composition Invoice FormatThe GST (Goods and Services Tax) Composition Scheme is a straightforward and user-friendly taxation scheme designed for small businesses in India. This scheme reduces the compliance burden for small taxpayers by allowing them to pay GST at a fixed rate… Read more: GST Composition Invoice Format

- Everything You Should Know About Car Bill InvoiceWhen it comes to car purchases, sales, repairs, or rentals, a car bill invoice is an essential document. This invoice serves as a record of the transaction and provides a detailed account of the services rendered or goods sold. Understanding… Read more: Everything You Should Know About Car Bill Invoice

Frequently Asked Questions

What is a purchase invoice?

A purchase invoice is a document sent by a seller to a buyer. It lists the goods or services provided, their prices, and the total amount due. This invoice serves as a formal request for payment and provides a record of the transaction for both parties. It includes details like the date, invoice number, and payment terms to ensure clarity and accuracy.

Why is a purchase invoice important?

A purchase invoice is important for record-keeping and legal reasons. It helps businesses track their expenses, manage cash flow, and prepare for taxes. It also serves as proof of the transaction, which can resolve any disputes. By having a detailed record, businesses can ensure accurate financial reporting and compliance with tax regulations.

What details should be included in a purchase invoice?

A purchase invoice should include the seller’s and buyer’s contact details, a unique invoice number, the date, a description of the goods or services, quantity, unit price, and the total amount due. It should also list payment terms and methods. Including these details ensures clarity and helps in maintaining accurate financial records.

How can I make a purchase invoice format?

To make a purchase invoice format, start by choosing a template. Add your business name, logo, and contact information. Include the buyer’s details, a list of items or services provided, and their prices. Specify the total amount due, payment terms, and methods. Review for accuracy before finalizing. This ensures you have a professional and comprehensive invoice.

Can I use software to create purchase invoices?

Yes, using invoicing software can simplify creating purchase invoices. These tools automate calculations, generate unique invoice numbers, and allow customization of templates. They also help in tracking payments and keeping records organized. Many invoicing software options integrate with accounting systems, making the process even more efficient.

What are the benefits of using invoicing software?

Invoicing software automates invoice creation, reducing errors and saving time. It allows for easy customization, keeps records organized, and integrates with other business tools like accounting software. Additionally, it helps track payments, sends reminders for overdue invoices, and generates reports, improving overall efficiency and accuracy in financial management.

How do I ensure my purchase invoice is accurate?

Double-check all details before sending the invoice. Verify the buyer’s information, item descriptions, quantities, unit prices, and totals. Ensure the invoice number and date are correct. Review payment terms and methods. Keeping your records organized and using software can help maintain accuracy and avoid mistakes.

What payment terms should I include in a purchase invoice?

Include the total amount due, payment due date, and accepted payment methods in the payment terms. You can also mention any late payment fees or discounts for early payment. Clear payment terms help avoid confusion and ensure timely payments, contributing to better cash flow management for your business.

How can I follow up on overdue invoices?

To follow up on overdue invoices, send a polite reminder email to the buyer. Include the invoice details, the amount due, and the new payment deadline. If there’s no response, consider calling the buyer or sending another reminder. Keeping track of your invoices and following up promptly can help ensure timely payments.

What should I do if there is an error on a purchase invoice?

If there is an error on a purchase invoice, correct it immediately and resend it to the buyer. Clearly communicate the changes and apologize for any inconvenience. Keeping accurate records and reviewing invoices before sending them can help prevent errors and ensure smooth transactions.