Creating a labour contractor invoice is an essential task for contractors who need to ensure they get paid for their services. An accurate and well-structured invoice can help avoid misunderstandings and ensure timely payments. In this blog, we will guide you through the process of creating a simple labour contractor invoice, covering everything from the necessary components to tips for making your invoices professional and effective.

Understanding the Importance of a Labour Contractor Invoice

A labour contractor invoice serves as a formal request for payment for services rendered. It provides a detailed record of the work performed, the agreed-upon rates, and the total amount due. This document is crucial for both the contractor and the client as it helps in maintaining clear communication and financial records. A well-prepared invoice can prevent disputes and ensure smooth transactions.

Essential Components of a Labour Contractor Invoice

Creating a labour contractor invoice format requires including several key components to ensure it is complete and professional. Here are the essential elements:

1. Header

The header of your invoice should include your business name, logo (if applicable), and contact information. This information helps your client recognize who the invoice is from and how to reach you if they have any questions. Including your logo can also make your invoice look more professional and enhance your brand recognition.

2. Client Information

Include the name and contact details of your client. This helps in identifying the recipient of the invoice and ensures that the payment is directed to the correct person or department. Make sure this information is accurate to avoid any delays or confusion.

3. Invoice Number

Assign a unique invoice number to each invoice you create. This helps in tracking payments and keeping your financial records organized. It also makes it easier to reference a specific invoice in case of any queries or disputes. Using a sequential numbering system can make it simpler to manage your invoices.

4. Invoice Date and Due Date

Clearly state the date the invoice is issued and the payment due date. This information is crucial as it sets the timeline for payment and helps in managing cash flow. The invoice date indicates when the invoice was created, while the due date specifies when the payment is expected.

5. Description of Services

Provide a detailed description of the services rendered. Break down the tasks performed, the hours worked, and the rate per hour or per task. This section should be as detailed as possible to avoid any confusion. Clearly explain what work was done, the time spent, and the cost associated with each task.

6. Total Amount Due

Calculate the total amount due by adding up the costs of all the services provided. Make sure to include any taxes, fees, or discounts, and clearly state the final amount that the client needs to pay. Double-check your calculations to ensure accuracy.

7. Payment Terms and Methods

Specify your payment terms and the methods of payment you accept. Common payment terms include net 30, net 15, or payment upon receipt. Accepted payment methods may include bank transfers, checks, or online payment platforms. Providing multiple payment options can make it easier for your client to pay you.

8. Additional Notes

Include any additional information that might be relevant to the invoice. This could be notes about the work performed, reminders about late fees, or a thank you note for the client’s business. Adding a personal touch can help build a positive relationship with your client.

Step-by-Step Guide to Creating a Labour Contractor Invoice

Creating a labour contractor invoice format is a straightforward process if you follow these steps:

Step 1: Choose an Invoice Template

Select a template that suits your business needs. There are many free and paid invoice templates available online that you can customize with your business information. Choose a template that is clean, professional, and easy to read.

Step 2: Add Your Business Information

Input your business name, logo, and contact information at the top of the invoice. This helps in branding and ensures that your client knows who the invoice is from. Make sure your contact information is up-to-date so your client can easily reach you if needed.

Step 3: Enter Client Details

Include the name and contact information of your client. Make sure this information is accurate to avoid any delays in payment. Double-check the spelling of the client’s name and the accuracy of their contact details.

Step 4: Assign an Invoice Number

Assign a unique number to the invoice. This can be a sequential number or a combination of letters and numbers that make sense for your record-keeping system. Using a consistent numbering system can help you stay organized.

Step 5: Include Invoice Date and Due Date

Input the date the invoice is created and the payment due date. This sets clear expectations for when the payment should be made. The due date is especially important as it helps in managing your cash flow and ensuring timely payments.

Step 6: Describe the Services Provided

Detail the services you provided, including the hours worked, tasks performed, and the rate charged. Be as specific as possible to avoid any misunderstandings. A detailed description helps the client understand what they are being charged for and justifies the cost.

Step 7: Calculate the Total Amount Due

Add up the costs of all services provided and include any applicable taxes, fees, or discounts. Clearly state the total amount due. Double-check your calculations to ensure that the total amount is accurate and reflects all the services provided.

Step 8: Specify Payment Terms and Methods

Outline your payment terms and accepted payment methods. This information helps your client understand how and when to pay you. Providing clear payment terms can help avoid any confusion or disputes later on.

Step 9: Add Additional Notes

Include any other relevant information in the notes section. This could be a thank you message, a reminder about late fees, or any special instructions. Personalizing your invoice with a thank you note can leave a positive impression on your client.

Step 10: Review and Send the Invoice

Review the invoice for accuracy and completeness. Once you are satisfied, send the invoice to your client via email, mail, or your preferred method of delivery. Following up with a confirmation that the invoice was received can also be helpful.

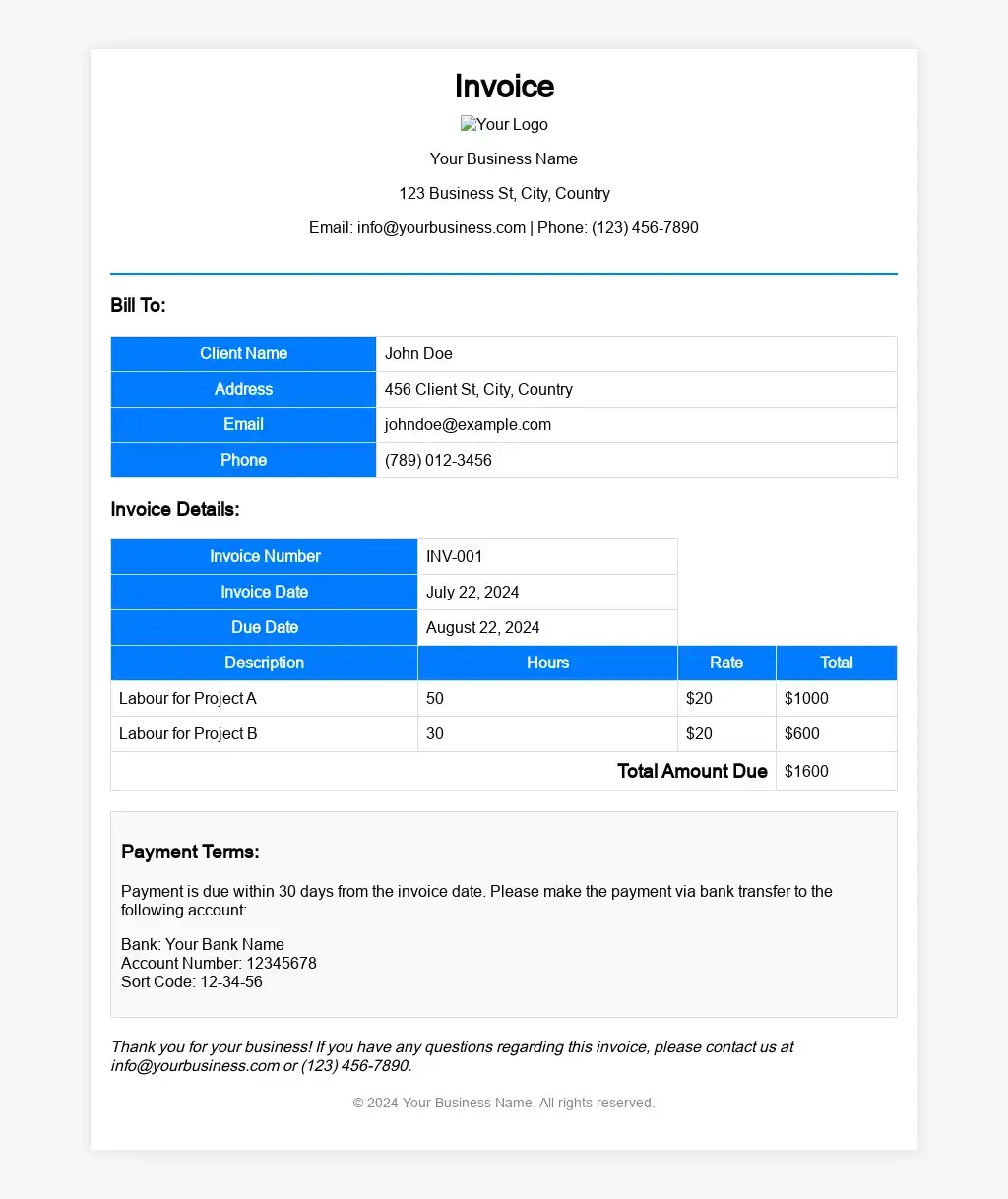

Labour Contractor Invoice Format Example

Labour Contractor Invoice

Contractor Information

Contractor Name

Company Name

Address Line 1

Address Line 2

City, State, ZIP Code

Phone Number

Email Address

Client Information

Client Name

Company Name

Address Line 1

Address Line 2

City, State, ZIP Code

Phone Number

Email Address

Invoice Details

Invoice Number: 001

Invoice Date: July 22, 2024

Due Date: August 22, 2024

| Description of Services | Hours Worked | Rate | Amount |

|---|---|---|---|

| Service Description 1 | 10 | $50 | $500 |

| Service Description 2 | 5 | $60 | $300 |

| Service Description 3 | 8 | $55 | $440 |

Total Amount Due: $1240

Payment Terms

Payment is due within 30 days from the invoice date. Late payments may incur a fee.

Payment Methods

Bank Transfer, Check, Online Payment

Thank you for your business!

Tips for Making Your Labour Contractor Invoice Professional

To ensure your invoice looks professional and helps in getting paid on time, consider the following tips:

1. Use a Professional Template

Using a professional invoice template can enhance the look of your invoice. Many templates are available online that you can customize with your branding. A well-designed template can make your invoice look more polished and professional.

2. Be Clear and Detailed

Providing a clear and detailed description of the services rendered helps in avoiding any confusion. Make sure to include all relevant information in an easy-to-understand manner. Detailed descriptions can also help justify the charges and make the client feel confident in paying the invoice.

3. Keep Records Organized

Maintaining organized records of all invoices issued and payments received helps in managing your finances effectively. Use an invoicing software or a spreadsheet to keep track of your invoices. Organized records can help you quickly reference past invoices and track your income.

4. Follow Up on Overdue Payments

If a payment is overdue, don’t hesitate to send a polite reminder to your client. Following up on overdue payments helps in ensuring that you get paid for your work. Regular follow-ups can also show your client that you are serious about getting paid on time.

5. Offer Multiple Payment Options

Offering multiple payment options makes it easier for your clients to pay you. Consider accepting bank transfers, checks, and online payments to accommodate different preferences. Making it convenient for clients to pay can help in receiving payments faster.

Common Mistakes to Avoid in Labour Contractor Invoices

When creating a labour contractor invoice format, it’s important to avoid common mistakes that can lead to delays in payment or misunderstandings. Here are some mistakes to watch out for:

1. Incomplete or Inaccurate Information

Ensure that all the information on the invoice is complete and accurate. Double-check client details, service descriptions, and amounts to avoid any errors. Inaccurate information can lead to delays in payment and potential disputes.

2. Lack of Clarity in Service Descriptions

Be specific and detailed in describing the services you provided. Vague descriptions can lead to confusion and disputes. Clearly outlining what work was done can help in justifying the charges and making the client feel confident in paying the invoice.

3. Not Including Payment Terms

Clearly state your payment terms on the invoice. This helps in setting expectations for when the payment should be made. Including payment terms can also help in avoiding any confusion or disputes regarding when the payment is due.

4. Forgetting to Assign an Invoice Number

Always assign a unique invoice number to each invoice. This helps in tracking payments and keeping your financial records organized. Using a consistent numbering system can make it easier to manage your invoices and track payments.

5. Not Following Up on Overdue Payments

If a payment is overdue, follow up with your client to remind them. Regular follow-ups can help in ensuring that you get paid on time. Following up on overdue payments can also show your client that you are serious about getting paid for your work.

Using Invoicing Software for Labour Contractor Invoices

Invoicing software can simplify the process of creating and managing your labour contractor invoices. Here are some benefits of using invoicing software:

1. Automates Invoice Creation

Invoicing software allows you to create professional invoices quickly and easily. You can use pre-built templates and customize them with your business information. Automating the invoice creation process can save you time and reduce the risk of errors.

2. Tracks Payments

Most invoicing software includes features for tracking payments. You can see which invoices have been paid, which are overdue, and send reminders to clients. Tracking payments can help you stay on top of your finances and ensure that you get paid on time.

3. Manages Client Information

Invoicing software allows you to store and manage client information. You can keep track of contact details, past invoices, and payment history. Managing client information can help you quickly reference past invoices and maintain good client relationships.

4. Generates Financial Reports

Many invoicing software programs offer features for generating financial reports. You can get insights into your income, expenses, and overall financial health. Generating financial reports can help you make informed business decisions and plan for the future.

Conclusion

Creating a simple labour contractor invoice is a straightforward process that can help ensure you get paid for your services. By including all the necessary components and following the steps outlined in this guide, you can create professional and effective invoices. Remember to use a clear and detailed template, maintain organized records, and follow up on overdue payments. Using invoicing software can further streamline the process and help you manage your finances effectively. With the right approach, you can make invoicing a seamless part of your business operations.

Also Read

- How to Ensure Data Security in Your Invoice Management SystemIn today’s digital age, businesses rely heavily on technology to streamline operations and improve efficiency. An invoice management system plays a crucial role in managing financial transactions and maintaining accurate records. However, with the increasing reliance on technology comes the… Read more: How to Ensure Data Security in Your Invoice Management System

- GST Invoice Software: Making Billing EasyIn today’s busy world of business, being efficient is super important. One big thing that needs to be super efficient is billing. With new technology, old-fashioned manual billing is out of date and can make a lot of mistakes. That’s… Read more: GST Invoice Software: Making Billing Easy

- GST Invoice Format for HotelIn the hospitality industry, especially for hotels, managing financial transactions is a very important task. One key part of this financial management is creating invoices that follow the rules of the Goods and Services Tax (GST) in India. Having a… Read more: GST Invoice Format for Hotel

- GST Composition Invoice FormatThe GST (Goods and Services Tax) Composition Scheme is a straightforward and user-friendly taxation scheme designed for small businesses in India. This scheme reduces the compliance burden for small taxpayers by allowing them to pay GST at a fixed rate… Read more: GST Composition Invoice Format

- Everything You Should Know About Car Bill InvoiceWhen it comes to car purchases, sales, repairs, or rentals, a car bill invoice is an essential document. This invoice serves as a record of the transaction and provides a detailed account of the services rendered or goods sold. Understanding… Read more: Everything You Should Know About Car Bill Invoice

Frequently Asked Questions

What information should a labour contractor invoice include?

A labour contractor invoice should include your business name, contact details, client’s information, unique invoice number, invoice date, due date, detailed description of services provided, hours worked, rate per hour or per task, total amount due, payment terms, accepted payment methods, and any additional notes. This information ensures clarity and helps in avoiding misunderstandings between you and your client. Including all these details makes your invoice professional and ensures timely payments, as the client has all the necessary information to process your payment without any delays.

How can I make my labour contractor invoice look professional?

To make your labour contractor invoice look professional, use a clean and well-structured template, include your business logo, and use clear, detailed descriptions of services. Ensure all information is accurate and complete, and use a consistent format. Adding a polite note or thank you message can also enhance the professionalism of your invoice. Review your invoice for any errors before sending it to your client. A professional-looking invoice not only helps in getting paid on time but also leaves a positive impression on your client.

Why is it important to assign a unique invoice number?

Assigning a unique invoice number to each invoice is important for tracking payments and maintaining organized financial records. It helps you quickly reference specific invoices in case of any queries or disputes. A unique invoice number also prevents confusion and ensures that both you and your client can easily identify and discuss a particular invoice. Using a sequential numbering system can make it easier to manage and keep track of all your invoices, ensuring you stay organized and efficient in your billing process.

What are common mistakes to avoid in labour contractor invoices?

Common mistakes to avoid in labour contractor invoices include incomplete or inaccurate information, vague descriptions of services, not including payment terms, forgetting to assign a unique invoice number, and not following up on overdue payments. These mistakes can lead to delays in payment, misunderstandings, and potential disputes with your clients. Double-check all information, provide clear and detailed descriptions, and set clear payment terms. Following up on overdue payments politely can help ensure you get paid on time and maintain good relationships with your clients.

How can invoicing software help with labour contractor invoices?

Invoicing software can help simplify the process of creating and managing labour contractor invoices by automating invoice creation, tracking payments, managing client information, and generating financial reports. It allows you to use professional templates, store client details, send payment reminders, and keep organized records. Using invoicing software saves time, reduces errors, and provides insights into your financial health, helping you make informed business decisions. It streamlines your invoicing process, ensuring you get paid on time and can efficiently manage your finances.

What are the benefits of using a professional invoice template?

Using a professional invoice template ensures your invoice is well-structured, clear, and visually appealing. It helps in presenting all necessary information in an organized manner, making it easy for clients to understand and process payments. A professional template enhances your business image, reflects your professionalism, and can improve your chances of getting paid on time. It also saves time, as you can quickly fill in the required details without worrying about the format. A consistent and professional look in your invoices can positively impact your client relationships.

How can I ensure my invoice gets paid on time?

To ensure your invoice gets paid on time, include clear payment terms, specify due dates, and provide multiple payment options. Make sure your invoice is accurate and complete, with detailed descriptions of services rendered. Sending invoices promptly after completing the work and following up with polite reminders for overdue payments can also help. Using invoicing software to automate reminders and track payments can make the process more efficient. Maintaining good communication with your client and addressing any concerns promptly can further improve your chances of timely payments.

Why is it important to include payment terms on an invoice?

Including payment terms on an invoice is important because it sets clear expectations for when the payment is due and helps manage cash flow. It informs the client of the time frame within which they need to make the payment, reducing the likelihood of delays. Payment terms also outline any late fees or discounts for early payments, encouraging timely payments. Clear payment terms help in avoiding misunderstandings and disputes, ensuring both parties are on the same page regarding the payment schedule and conditions.

What details should be in the description of services on an invoice?

The description of services on an invoice should include a detailed account of the tasks performed, hours worked, and the rate charged for each task or hour. Be specific about the nature of the work, the timeframe, and any materials or additional costs involved. Clear and detailed descriptions help the client understand what they are being charged for and justify the costs. This transparency reduces the likelihood of disputes and ensures the client has all the information needed to process the payment without any confusion.

How can I follow up on overdue payments professionally?

To follow up on overdue payments professionally, send a polite reminder email or call your client, referencing the invoice number and due date. Express understanding and inquire if there are any issues or reasons for the delay. Offer to provide any additional information they might need to process the payment. Be courteous and maintain a positive tone, emphasizing the importance of timely payment for maintaining good business relations. Regular follow-ups can help ensure you get paid while maintaining a professional and respectful relationship with your client.