Checking your GST return status is an important task for every business in India. GST, or Goods and Services Tax, is a tax that businesses must pay on goods and services. Every business that is registered under GST needs to file returns on time. But after filing, it’s important to check the status to make sure everything is complete and there are no issues. In this blog, we will explain, in simple steps, How To Check GST Return Status easily.

Why Is It Important to Check Your GST Return Status?

Checking your GST return status helps you:

- Confirm that your return was filed successfully.

- Make sure there are no mistakes in your return.

- Know if you need to provide more information.

- Avoid penalties or extra charges for late filing.

- Stay compliant with GST laws.

By regularly checking your GST return status, you can make sure everything is running smoothly and avoid any problems later on.

What You Need Before Checking Your GST Return Status

Before you start checking your GST return status, make sure you have:

- GSTIN (Goods and Services Tax Identification Number): This is your unique ID number under GST.

- Username and Password: You need to have registered on the GST portal and have your login details.

- Return Period: You should know which period you are checking (monthly, quarterly, or yearly).

Once you have these details, you are ready to check the status.

How to Check GST Return Status on the GST Portal

You can easily check your GST return status on the official GST website. Here’s how to do it step by step.

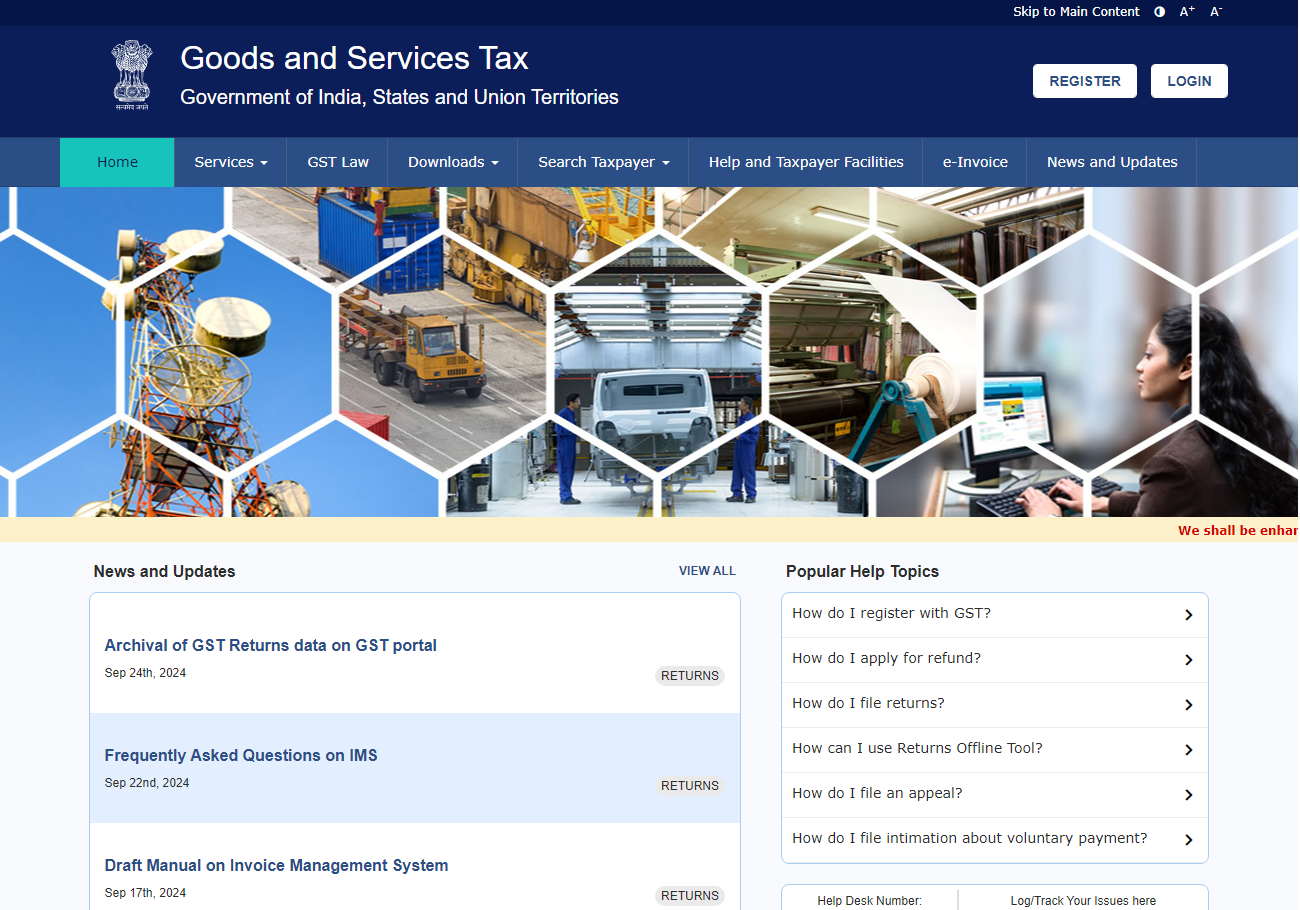

Step 1: Visit the GST Portal

Go to the official GST website by typing www.gst.gov.in in your web browser.

Step 2: Log In to Your Account

Click the ‘Login’ button on the top right of the page. Enter your username and password to log in. If you don’t have an account yet, you will need to create one by clicking ‘New User’.

Step 3: Go to the ‘Services’ Tab

Once you’re logged in, go to the ‘Services’ tab at the top. Then, under ‘Returns’, select ‘Track Return Status’.

Step 4: Choose the Return Period

You will be asked to enter the return filing period. Choose the period for which you want to check the status and click ‘Search’.

Step 5: View Your GST Return Status

After entering the period, your GST return status will be displayed on the screen. You will see details like the return filing date and the current status of your return.

Understanding Different GST Return Statuses

While checking the status, you might see different terms. Here’s what they mean:

- Filed: Your GST return has been successfully filed.

- Not Filed: You have not filed the return for the selected period.

- Filed with Errors: There are some mistakes in your return, which you need to correct.

- Pending for Action: Your return needs further action, such as payment or corrections.

- Validated but Pending: Your return is validated but not yet completed.

- Submitted: Your return has been submitted, but some steps are still left.

Knowing these terms will help you understand what needs to be done next.

Other Ways to Check GST Return Status

In addition to the GST portal, there are other ways you can check the status of your GST returns.

1. Using the Mobile App

You can use the GST mobile app to check your return status. Download the app from the Google Play Store or Apple App Store, log in using your GST credentials, and check your status.

2. Via SMS

If you don’t have internet access, you can also check the status via SMS. Send an SMS in the format: ‘GST (Your GSTIN) (Return Period)’ to the official GST number, and you will get a reply with your return status.

3. Using GSP (GST Suvidha Providers)

GSPs are third-party service providers authorized by the government. You can use them to file returns and check your GST status. This option is useful for businesses that want additional services.

What to Do If Your GST Return Shows ‘Filed with Errors’?

If you see that your GST return status is ‘Filed with Errors,’ you need to fix the mistakes. Here’s what to do:

- Find the Error: Look carefully at the return to understand what went wrong.

- Correct the Error: Make the necessary corrections in the next filing period.

- Resubmit the Return: After fixing the mistakes, submit the corrected return.

It’s important to act quickly to avoid penalties or additional charges.

Common Issues When Checking GST Return Status

Sometimes, you might face issues while checking your return status. Here are some common problems and how to solve them:

- Can’t Log In: Double-check your username and password. Use the ‘Forgot Password’ option if needed.

- Portal Not Working: The GST portal may be down during peak hours. Wait for a while and try again.

- Wrong Return Period: Ensure that you are selecting the correct return period.

How Often Should You Check Your GST Return Status?

It’s a good practice to check your GST return status after every filing to ensure everything is in order. You can also check it regularly, especially during the tax season, to stay on top of your filings.

Conclusion

Checking your GST return status is a simple but essential process. It helps you confirm that your returns have been filed properly and that no further action is required. Whether you prefer using the GST portal, mobile app, SMS, or a GSP, checking your return status is easy and ensures that your business stays compliant with GST regulations. By following the steps outlined in this guide, you can quickly check your GST return status and address any issues that might arise.

Also Read

- How Is a Purchase Bill with GST Different from a Sales Invoice?Running a business in today’s GST-enabled economy requires more than just selling and buying. It’s about being organised, compliant, and aware of what each document in your billing system stands for. One common confusion many businesses face is the difference… Read more: How Is a Purchase Bill with GST Different from a Sales Invoice?

- How Can You Generate a Mobile GST Bill in Seconds?Running a shop is hard enough. But when billing takes forever and GST compliance gets messy, things can slow down. That’s where a Mobile GST Bill comes to the rescue. Whether you run a busy garment store or a local… Read more: How Can You Generate a Mobile GST Bill in Seconds?

- What Happens If GST on Advance Received Is Not Paid on Time?Running a business in India requires keeping pace with ever-evolving tax laws, and GST in advance is one such area that many businesses often overlook sometimes unintentionally. But missing out on timely GST payment on advances can lead to unnecessary… Read more: What Happens If GST on Advance Received Is Not Paid on Time?

- How Does the 9988 HSN Code Impact GST Filing for Businesses?Navigating the complexities of GST can be daunting, especially for service-based businesses in India. Among the many elements of GST compliance, the HSN (Harmonised System of Nomenclature) code plays a crucial role in categorising goods and services. One such classification… Read more: How Does the 9988 HSN Code Impact GST Filing for Businesses?

- What Happens If You Don’t Mention GST in Bill Properly?Always staying compliant with tax norms isn’t just a formality it’s essential. One of the most crucial aspects under India’s GST regime is issuing a proper bill with correct GST details. But have you ever wondered what can go wrong… Read more: What Happens If You Don’t Mention GST in Bill Properly?

Frequently Asked Question

How do I check my GST return status online?

You can check your GST return status online by visiting the GST portal at www.gst.gov.in. Log in with your username and password, navigate to the ‘Services’ section, and select ‘Track Return Status’. Enter the return period to view your status.

What documents do I need to check my GST return status?

To check your GST return status, you will need your GSTIN (Goods and Services Tax Identification Number), your username and password for the GST portal, and the return period you wish to check.

Can I check my GST return status via mobile app?

Yes, you can check your GST return status using the GST mobile app. Simply download the app from the Play Store or App Store, log in using your credentials, and track your return status.

What does ‘Filed with Errors’ mean in GST return status?

‘Filed with Errors’ means that your GST return has been submitted, but there are mistakes that need to be corrected. You should review the return, fix the errors, and resubmit it in the next filing.

How often should I check my GST return status?

It’s a good practice to check your GST return status after every filing to ensure everything is in order. Regular checks, especially during tax seasons, help avoid issues and ensure compliance.

What should I do if I can’t log in to the GST portal?

If you can’t log in, double-check your username and password. If needed, use the ‘Forgot Password’ option to reset your password. Ensure you are entering the correct GSTIN as well.

Can I check my GST return status via SMS?

Yes, you can check your GST return status via SMS. Send an SMS in the format: ‘GST (Your GSTIN) (Return Period)’ to the official GST number, and you’ll receive your return status.

What does ‘Validated but Pending’ mean in GST status?

‘Validated but Pending’ means your return has been validated by the system, but it is still awaiting final processing. It may require additional action before completion.

What should I do if my GST return shows ‘Pending for Action’?

If your return shows ‘Pending for Action,’ you need to provide additional details or complete certain steps. Log in to the portal, check the required actions, and submit any necessary information.

Can I check past GST return statuses on the portal?

Yes, you can check past GST return statuses on the GST portal. Log in, go to the ‘Track Return Status’ section, and select the period for which you want to view the status, even for previous months or years.