Creating an e-invoice format is important for businesses that want to make their invoicing process more efficient and accurate. An e-invoice is a digital version of a traditional paper invoice. It helps speed up transactions and reduces the chance of errors. This guide will walk you through the steps to create an e-invoice format, making sure you include all necessary details.

What is an E-Invoice Format?

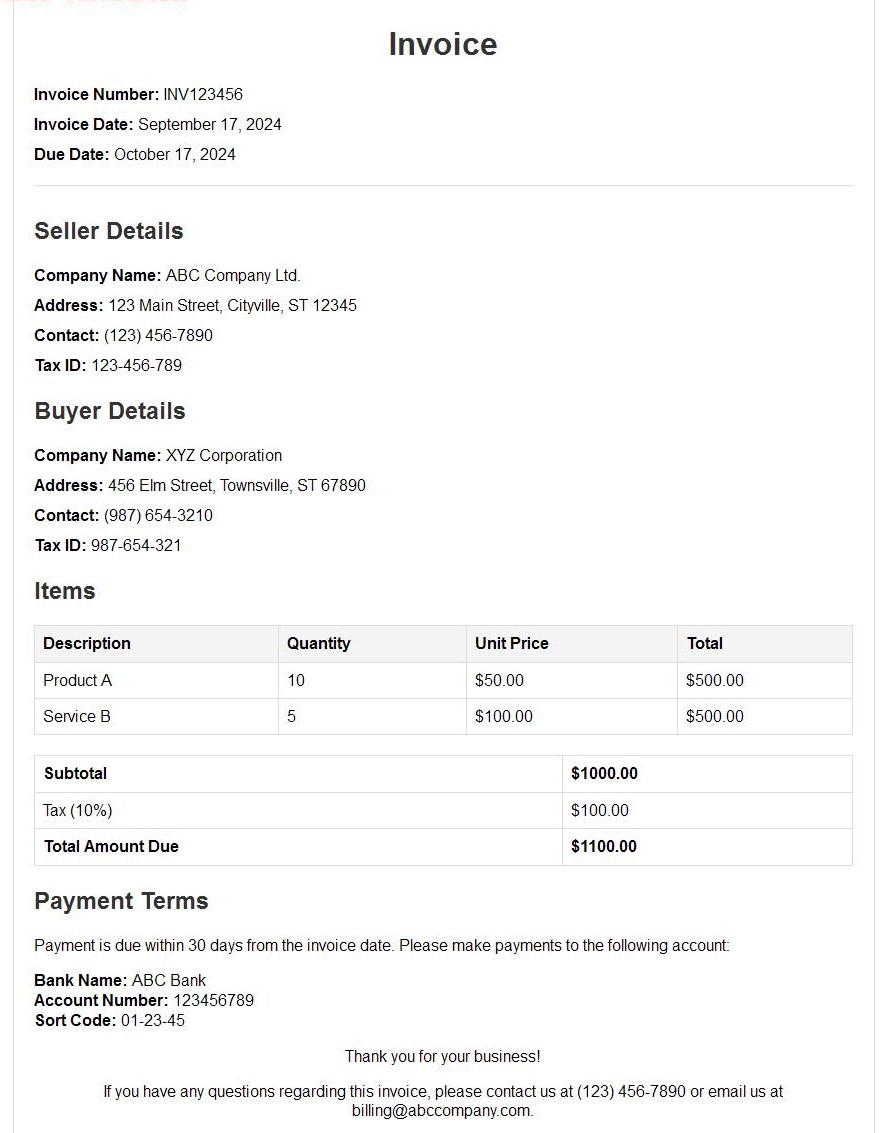

An e-invoice format is a template that includes all the important information needed for billing. It should have a clear structure so that both the seller and buyer can easily understand it. Here’s what typically goes into an e-invoice:

Key Parts of an E-Invoice

- Invoice Header: This includes the invoice number, the date it was issued, and a reference number. This helps in tracking and finding the invoice later.

- Seller’s Details: This section should have the seller’s name, address, contact details, and tax identification number. It tells who is sending the invoice.

- Buyer’s Details: Similar to the seller’s details, this includes the buyer’s name, address, contact information, and tax identification number. It makes sure the invoice reaches the right person.

- Itemized List of Goods/Services: This part should list all the items or services provided. Include details like quantities, unit prices, and the total amount for each item.

- Tax Details: Add information about taxes, like VAT or GST, if applicable. This helps in ensuring that the invoice meets tax regulations.

- Total Amount Due: Clearly state how much the buyer needs to pay in total, including any taxes or discounts.

- Payment Terms: Include information about when the payment is due, any discounts for early payment, and how the payment should be made.

- Additional Information: This can include any extra details like delivery terms or special notes.

How to Create an E-Invoice Format

Here are the steps to create your e-invoice format:

Step 1: Choose Your Software

Pick software that can help you create e-invoices. Look for one that allows you to customize templates and connects with your accounting system. This will make the process easier and more consistent.

Step 2: Design the Template

Design your invoice template to include all the key parts listed above. Make sure it looks clean and professional. Use headings and bullet points to make it easy to read. Avoid cluttering the invoice with unnecessary details.

Step 3: Include All Required Information

Make sure your e-invoice format includes all the mandatory information required by law. This includes the seller’s and buyer’s details, invoice number, date, and tax details. Missing information can lead to problems.

Step 4: Customize for Your Needs

Adjust the template to fit your specific needs. For example, if you offer discounts or have special payment terms, include these in the invoice.

Step 5: Test the Template

Before using the e-invoice format, test it by creating a few sample invoices. Check that everything looks correct and make any necessary changes.

Step 6: Use and Monitor

Start using your e-invoice format and keep an eye on how it’s working. Be open to feedback and make improvements as needed.

Benefits of Using E-Invoices

E-invoices have several advantages:

1. More Accurate

E-invoices reduce the chance of mistakes that can happen with manual data entry. Automation helps ensure that all information is correct.

2. Faster Processing

Electronic invoices are processed quicker than paper ones, leading to faster approvals and payments.

3. Cost Savings

Using e-invoices cuts down on costs related to paper, printing, and postage. It also reduces the time spent on administrative tasks.

4. Better Compliance

E-invoices help you meet legal requirements by including all necessary information in a standard format.

5. Environmentally Friendly

Switching to e-invoices helps reduce paper waste, which is better for the environment.

Common Mistakes to Avoid

When creating your e-invoice format, avoid these common mistakes:

1. Incomplete Information

Make sure all necessary details are included. Missing information can cause confusion and payment delays.

2. Inconsistent Formatting

Keep your formatting consistent. An inconsistent format can make invoices hard to read.

3. Ignoring Legal Requirements

Stay up to date with legal requirements for e-invoicing. Failure to do so can lead to penalties.

4. Overcomplicating the Design

Keep the design simple and professional. Avoid adding unnecessary details.

5. Skipping Testing

Always test your e-invoice format before using it. This helps catch any errors and ensures everything works as it should.

Conclusion

Creating an e-invoice format is a key step in modernizing your invoicing process. By following these steps and avoiding common mistakes, you can create an e-invoice format that is accurate, efficient, and compliant with regulations. If you have any questions or need further help with creating an e-invoice format, feel free to ask.

Also Read

- How to Ensure Data Security in Your Invoice Management SystemIn today’s digital age, businesses rely heavily on technology to streamline operations and improve efficiency. An invoice management system plays a crucial role in managing financial transactions and maintaining accurate records. However, with the increasing reliance on technology comes the… Read more: How to Ensure Data Security in Your Invoice Management System

- GST Invoice Software: Making Billing EasyIn today’s busy world of business, being efficient is super important. One big thing that needs to be super efficient is billing. With new technology, old-fashioned manual billing is out of date and can make a lot of mistakes. That’s… Read more: GST Invoice Software: Making Billing Easy

- GST Invoice Format for HotelIn the hospitality industry, especially for hotels, managing financial transactions is a very important task. One key part of this financial management is creating invoices that follow the rules of the Goods and Services Tax (GST) in India. Having a… Read more: GST Invoice Format for Hotel

- GST Composition Invoice FormatThe GST (Goods and Services Tax) Composition Scheme is a straightforward and user-friendly taxation scheme designed for small businesses in India. This scheme reduces the compliance burden for small taxpayers by allowing them to pay GST at a fixed rate… Read more: GST Composition Invoice Format

- Everything You Should Know About Car Bill InvoiceWhen it comes to car purchases, sales, repairs, or rentals, a car bill invoice is an essential document. This invoice serves as a record of the transaction and provides a detailed account of the services rendered or goods sold. Understanding… Read more: Everything You Should Know About Car Bill Invoice

Frequently Asked Questions

What is an e-invoice format?

An e-invoice format is a digital template used for creating invoices. It includes necessary details like seller and buyer information, item descriptions, tax details, and payment terms. This format helps in accurate, efficient electronic transactions between businesses.

Why should I use an e-invoice format?

Using an e-invoice format improves accuracy, speeds up processing, and reduces costs compared to paper invoices. It also ensures compliance with tax regulations and helps in tracking payments more efficiently.

How do I choose the right software for e-invoicing?

Choose software that offers customizable templates, integrates with your accounting system, and supports e-invoice standards. Look for features that fit your business needs and ensure ease of use and compliance.

What should be included in an e-invoice format?

An e-invoice format should include the invoice number, date, seller and buyer details, itemized list of goods or services, tax information, total amount due, and payment terms. This ensures all necessary information is provided.

How can I ensure my e-invoice format is compliant?

To ensure compliance, include all required details like tax identification numbers, and adhere to local e-invoicing regulations. Regularly check for updates to compliance rules and make adjustments to your format as needed.

Can I customize my e-invoice format?

Yes, you can customize your e-invoice format to fit your business needs. You can add or modify sections like discounts, special terms, or additional notes to better suit your invoicing requirements.

How do I test my e-invoice format before use?

Generate sample invoices using your format to check for accuracy and proper layout. Ensure all details are correctly displayed and make any necessary adjustments based on testing results.

What are the benefits of e-invoicing over paper invoices?

E-invoicing offers faster processing, reduced errors, cost savings on paper and postage, and better compliance with regulations. It also supports a more environmentally friendly approach by reducing paper usage.

How do I handle errors in my e-invoice format?

If you find errors, correct them in your invoice template. Recheck all sections for accuracy and update any information as needed. Regularly review your e-invoice format to prevent future issues.

What should I do if my e-invoice format is not accepted?

If your e-invoice is not accepted, check if it meets all required standards and includes necessary details. Ensure compliance with local regulations and adjust your format accordingly. Seek feedback from the recipient if needed.